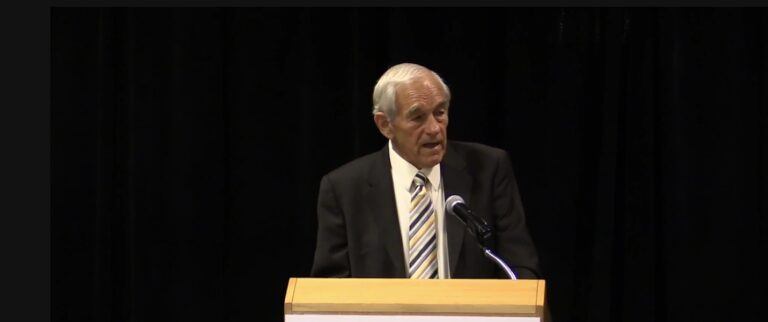

Texas Libertarian Dr. Ron Paul, who is a former U.S. presidential candidate (three times, in 1988, 2008, and 2012), discussed his views on blockchain technology and cryptocurrencies in an interview on Thursday (August 15). Also, a day earlier, he issued a statement on the Federal Reserve’s upcoming FedNow Service.

Blockchain and Cryptocurrencies

Dr. Paul’s comments came during an interview on Thursday on CNBC’s “Squawk Alley”.

When asked about Facebook’s proposed cryptocurrency Libra, Paul said that he did not know what was going to happen with Libra, but had this to say about blockchain and crypto in general:

I'am all for cryptocurrencies and blockchain technology because I like competing currencies… I'm for the least amount of regulation. I don't know what's going to happen to cryptocurrencies. I think it's great idea. And I only have one rule: no fraud.

The FedNow Service

America’s central bank, the Federal Reserve, announced via a press release issued on August 5 that Federal Reserve Banks “will develop a new round-the-clock real-time payment and settlement service, called the FedNow℠ Service, to support faster payments in the United States.”

On Wednesday (August 14), Campaign for Liberty, a nonprofit political organization founded by Ron Paul that promotes respect for the U.S. Constitution, issued a statement (posted on its national blog) by its Chairman, Ron Paul, about the proposed FedNow Service:

“Consumers already have numerous options to make real-time payments, so the Federal Reserve’s decision to begin work on a central bank-run and controlled real payments system—what Competitive Enterprise Institute Senior Fellow John Berlau calls “FedNow”—is baffling.

“A Federal Reserve-run real payments system will crowd out private alternatives, leaving consumers with one government-run option for real-time payments. This will be bad for consumers and real-time entrepreneurs but good for power-hungry Federal Reserve bureaucrats who will no doubt use FedNow to help “protect” the Federal Reserve’s fiat currency system from competition from crypto currencies.”