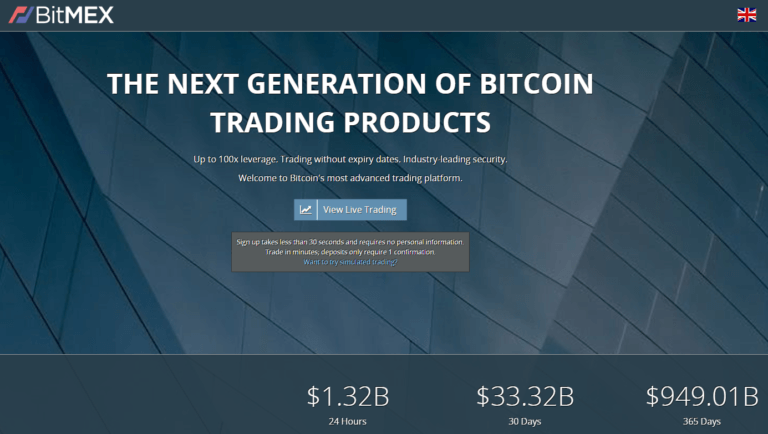

The UK’s Advertising Standards Authority (ASA) has upheld a complaint against crypto-derivatives exchange BitMEX over a bitcoin ad it placed that the regulator believes was misleading.

The ad, placed in the Times newspaper by BitMEX on January 3, claimed to celebrate the 10th anniversary of the first block to be mined on the Bitcoin blockchain and showed a graph of the period spread across two pages.

But instead of using a normal graduated scale, the “y” axis on the graph which represented the price used a logarithmic scale so the equally-spaced values on that scale did not increase by the same amount each time, but increased by orders of magnitude.

Misleading

The ASA said that people viewing this chart were “likely to be misled about bitcoin’s value and stability in recent years and therefore about what any investments they might previously have made would have yielded”.

BitMEX countered that the ad had included phrases that explained the potential risks associated with investing in bitcoin. It said it had described bitcoin as “still very much an experiment” and that “the road ahead will be challenging” and that it warned against “price volatility”.

Here’s one such sentence from the ad, however:

Despite price volatility and how entirely bonkers the system seems, the Bitcoin protocol appears robust. And although the road ahead will be challenging, there’s a reason to believe Bitcoin’s still got a chance at glory.

The regulator said it considered this “a clear promotional statement of bitcoin’s merits and did very little to warn consumers of any risks”. The ASA concluded:

We considered that the ad had misleadingly exaggerated the return on investment, failed to illustrate the risk of the investment and therefore concluded it was in breach of the Code.

ASA Action

BitMEX was barred from using the ad in the UK and advised the exchange to make sure future promotions could be “readily understood” by the audience it was aiming at and that investment risks were clearly indicated.

The ad – placed in the Times on January 3 – received four complaints in total: all four said the ad exaggerated the return on investment and was misleading. Two of the four also said the ad failed to illustrate the risk of investment.