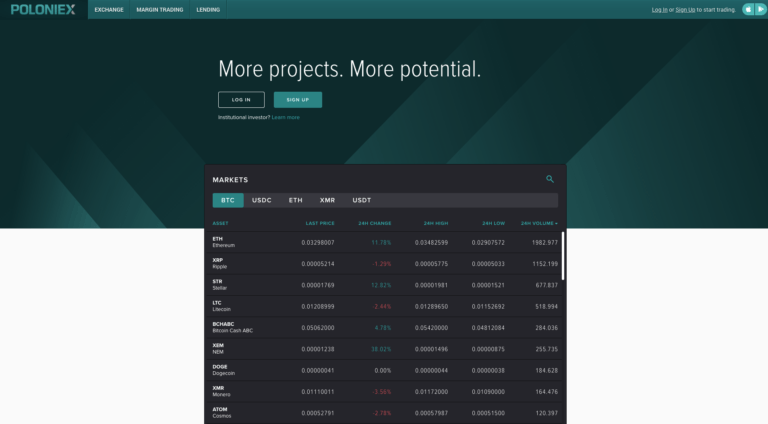

A couple of weeks after the Poloniex exchange came up short to the tune of ₿1,800 (over $14 million at current prices) as a result of botched margin trading of the obscure CLAM altcoin, the U.S.-based exchange announced their intention to distribute the losses among its margin holders and lenders.

Poloniex claim that affected users make up only 0.4% of total users, who necessarily cannot include U.S. residents as these customers cannot trade using margin as of November 2018.

For these users who have outstanding bitcoin loans through the exchange, each loan will face a 16% haircut on the principal sum, regardless of whether or not those users were trading CLAMs.

This distribution of losses, commonly referred to as “socializing” losses, is often the last resort for crypto exchanges when margin trading goes wrong – and the precise reason why exchanges hold insurance funds.

What Happened

Detailed in the official blog post, the essential problem was the lack of liquidity of CLAMs. Users trading CLAMs on margin traded also using CLAMs as the principal – rather than something more dependable like BTC. Thus, when the CLAM price tanked, the CLAMs held as principal for the trades also lost their value as collateral – and thus were nonviable to repay the counterparties in terms of BTC.

Poloniex say they will “[pursue] the defaulted borrowers to get them to repay,” in addition to a number of other measures.

These measures include, delisted four assets (including CLAM) they consider too illiquid to margin trade – because illiquid assets’ prices can fluctuate very quickly and are inherently unstable to trade; and generally more closely “monitoring” margin markets for problems such as “major price slippage and over-concentrated positions.”

If this is actually what happened and Polo allowed a tiny shitcoin as collateral for margin trading that can be crashed with a $50k sell order, that's borderline criminal in terms of their negligence. https://t.co/JK3z8ODZaL

— Hasu (@hasufl) June 6, 2019

The prospect of margin trading illiquid altcoins may become more typical in the coming months, as perhaps the largest cryptoasset exchange, Binance, is slated to introduce margin trading to the general public soon on its Malta-registered platform (and already has in beta mode).

According to a legal advisor solicited by The Block, Poloniex could face unfriendly legal attention as a result of socializing users’ losses.

That Polo allowed someone to build such a massive position using this scheme and then not even prevented him from withdrawing is hard to forgive. All that regulation is worth nothing if you don't have basic risk management on your exchange.

— Hasu (@hasufl) June 7, 2019

Some in the crypto industry have slammed Poloniex as a result of what they perceive as, essentially, incompetence.