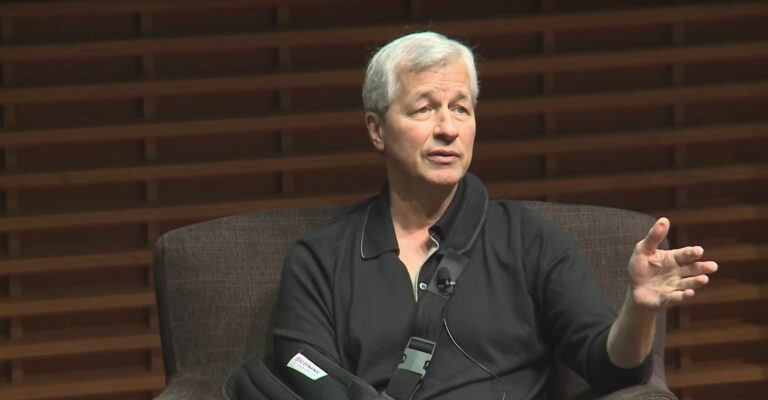

In a recent interview with Yahoo Finance, Jamie Dimon, the Chairman and CEO of JPMorgan Chase & Co., the largest bank in the U.S., said that he didn’t consider crypto “an existential threat to J.P. Morgan’s core businesses.”

Dimon’s comments came during an interview (published on June 27) with Andry Serwer, Yahoo Finance’s Editor-in-Chief.

But before we take a closer look at the highlights from this interview, it is worth remembering that Dimon has long been a fan of blockchain technology but not cryptocurrencies. In fact, he called Bitcoin a “fraud” as early as September 2017.

According to Bloomberg, on 13 September 2017, after calling Bitcoin “a fraud”, he went on to say that it was “worse than tulip bulbs.” And if a JPMorgan trader began trading in Bitcoin, the J.P. Morgan CEO said that he would “fire them in a second.”

He went on to say that:

If you were in Venezuela or Ecuador or North Korea or a bunch of parts like that, or if you were a drug dealer, a murderer, stuff like that, you are better off doing it in bitcoin than U.S. dollars. So there may be a market for that, but it’d be a limited market.

J.P. Morgan’s Unveiling of Its Own Cryptocurrency

On February 14, J.P. Morgan announced that it had become “the first U.S. bank to create and successfully test a digital coin representing a fiat currency.” This cryptocurrency, which is called “JPM Coin”, is “a digital coin designed to make instantaneous payments” between “institutional clients”. More specifically, it is “a digital coin representing United States Dollars held in designated accounts at JPMorgan Chase N.A.”, i.e. a JPM Coin “always has a value equivalent to one U.S. dollar. ” And when “one client sends money to another over the blockchain,” JPM Coins are “transferred and instantaneously redeemed for the equivalent amount of U.S. dollars, reducing the typical settlement time.”

By now, J.P. Morgan had modified its stance on cryptocurrencies:

We have always believed in the potential of blockchain technology and we are supportive of cryptocurrencies as long as they are properly controlled and regulated. As a globally regulated bank, we believe we have a unique opportunity to develop the capability in a responsible way with the oversight of our regulators. Ultimately, we believe that JPM Coin can yield significant benefits for blockchain applications by reducing clients’ counterparty and settlement risk, decreasing capital requirements and enabling instant value transfer.

Furthermore, the bank said that the “JPM Coin will be issued on Quorum Blockchain and subsequently extended to other platforms.”

Jamie Dimon’s Interview With Yahoo Finance

Now, going back to the Dimon’s interview with Yahoo Finance’s Andry Serwer, the first question he got asked was what he thought about Libra, Facebook’s new cryptocurrency. Dimon answered:

Well, blockchain is real. We have the JPMorgan Coin blockchain… I think there are serious issues around money… And you have seen the government react like 'what does that mean when you send money around the world?' Will it follow banking rules — KYC, BSA, AML — or are they not?

He then went on to say:

I always look at these systems. We'd like to do some of it too… And we don't always want to be forced into someone's ecosystem.

Dimon was then asked if crypto represented “an existential threat to J.P. Morgan’s core businesses.”

He replied that he didn’t think so:

We're going to have competitors. So, whether it's a cryptocurrency competitor, or another FinTech competitor, we're going to have competitors. And I tell our people: 'Don't guess. You know they are there, you know they are coming, and you know they want to eat your lunch. Assume it.

Goldman Sachs’ View of Facebook’s Libra Coin

As for Goldman Sachs Group Inc., the fifth-largest bank in the U.S. by assets, its CEO, David Solomon, was also asked about Facebook’s project Libra during an interview (published on June 28) with France’s Les Echos newspaper.

This was his answer:

I can not comment on any discussions we may have with our clients. What I can tell you is that I find the principle interesting. We do extensive research on the concept of 'tokenization', the potential of which we believe, and which designates the creation through the blockchain of a stable digital currency based on a basket of real currencies that can move money across borders and without friction. This is the direction in which the payment system will go. But as to whether it is this platform or one of the other fifty that people are watching that will make the most progress, I can not tell you.