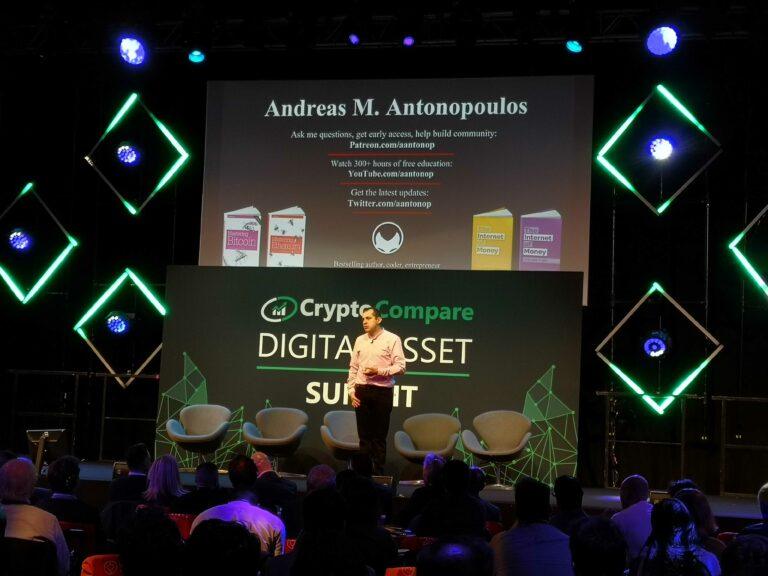

Speaking to CryptoGlobe at the CryptoCompare Digital Asset Summit in London, the author of “The Internet of Money” and a well-known cryptocurrency expert, Andreas M. Antonopoulos, revealed his thoughts on future cryptocurrency technology and impact of regulations on the market.

Antonopoulos revealed he believes that a lot of the things we’re currently dealing with in cryptocurrency wallets will eventually fade into the background in the name of a better user experience, and that regulations may only be harmful for the space’s goal of financial inclusion.

CryptoGlobe: During your talk [at the CryptoCompare Digital Asset Summit] you kind of approached our question, which is on atomic swaps. Essentially you said that one day, we will have a kind of ‘smart wallets’ that will do everything for us, we’ll just send the transaction. I assume you think they’re positive, and they’ll allow individuals to exchange peer-to-peer without the need for anything else?

Andreas Antonopoulos: Yes, I think that a lot of the details that we have to put in the forefront of the user interface today will actually fade into the background. The reason I say that is because I’ve seen that happen in a number of technologies in my, in my career, and my experience in the Information Sciences.

We’ve seen that with the internet, for example. When I first started with the internet, a lot of the nitty gritty things, like IP addresses and configurations of network drivers, and DNS, and things like that were right up front and had to be managed by the users themselves, just like today, you know, you have to choose Bitcoin addresses and send them to each other and they’re these very difficult to read things.

There’s no reason why we can’t gradually make those details disappear into the backgrounds. When you operate the internet today, you don’t consider how your packets are being routed or whether you’re using a VPN or not, or how many layers there are between you and a website or where the information is cached on the way there. All of that happens magically, in the background.

Some of that’s a good thing. Some of that’s a bad thing. Sophisticated users want a bit more control, but mainstream adoption also depends on hiding some of that complexity.

I think, in the end wallets are going to become much more simple to the user, but much more complex behind the scenes – more sophisticated, they’re going to be doing intelligent routing, they’re going to be swapping currencies, one for the other, in order to achieve the best results, given a set of circumstances. I think a lot of those things going to be auto-negotiated, just like when you use SSL on your browser, you have no idea which encryption algorithm it’s using. You only know if it’s using a good one or bad one. If you look at the color of the padlock.

There’s no reason why you would need to know or choose a currency: why not have your wallets negotiate the best cryptocurrency to use with the vendor you’re exchanging or the other peer you’re exchanging value with? ‘I take the following 20 cryptocurrencies. Great. I have three of those. But I’d actually like to change to another one. Let me do a quick atomic swap and pay you in your preferred currency.’ Just like we do with routing.

CryptoGlobe: Recently the Financial Action Task Force put out guidelines on transactions that require VASPs to have an identity attached to them. What do you think about that? Is it bullish for Bitcoin?

Antonopoulos: I think what it’s going to do again, and again, is prove that, especially in countries where the government is taking a fairly authoritarian approach towards finance, they’re willing to sacrifice billions of people into poverty in order to create this illusion of safety. The truth is, we cannot address crime, or poverty, or crime arising out of poverty, by doing totalitarian surveillance of transactions.

For thousands of years, we had anonymous transactions over cash and civilization didn’t end. In fact, it thrived and billions were raised out of poverty. I think in the long run, the historical idea that we can track every transaction, every time will be a historical aberration. I think it’s a very dangerous idea, because ultimately, criminals will be able to have financial privacy, because they will use the systems that give them financial privacy because they’re willing to pay the price.

People lining up to buy tickets instead of using their public transport cards, worried that their ride history will be used against them as evidence of their participation in the #NoToChinaExtradition protests today pic.twitter.com/FWoWca6Z6a

— Christy Choi (@jchristychoi) June 12, 2019

What this does is it robs the innocent of their right to financial privacy, in order to pretend to chase criminals. It also puts power in the hands of people who are likely to become corrupted by this. If there is a lever of power that gives you ultimate surveillance and control over the financial lives of millions of people, the kind of people who are attracted to take control of that lever of power are the worst sociopathic criminals in society. One of the days you’re going to elect one of them as President, Prime Minister, or they’re going to become the new king, and then your freedoms are gone.

I think it’s very dangerous to continue to follow this wrong path. The good news is that these crazy ideas that everybody has to participate in surveillance in order to have safety and freedom. This fascist idea that for the good of society, we have to submit to total surveillance by government is going to fail. And the reason it’s going to fail is because many people will have the choice to use something else. These people are already excluded from the financial and banking system anyway, and there’s billions of them.

So I’m more focused on building technology. The regulators can only regulate what happens within their borders – if they creates circumstances that make it impossible for crypto companies to operate legitimately within their borders, the crypto companies will then leave, [but] the crypto is going to stay.

Then it’s going to be used primarily by criminals, who are still going to use it. The only difference is the middle class won’t be able to use it. And the startup companies that are creating innovation will move to other places and create jobs somewhere else. You can take your country out of crypto, but you can’t take crypto out of your country.

CryptoGlobe: So ideally, do you think governments should just stay away from the cryptocurrency space and let the free market do its thing? What do you think the governmental approach to the cryptocurrency space should be?

Antonopoulos: They should regulate custodians. They should regulate custodians because custodians are dangerous, in any market. And maybe they should start by regulating the banks and multinational corporations that are selling our private data to the highest bidder, maybe they should regulate surveillance capitalism, maybe they should regulate custodian banks that are taking our money into their deposits, and using it to gamble on these corrupt markets and making the economy more and more fragile.

Unfortunately, those same people pay for every one of these politicians’ campaigns, so they are unlikely to do any of that regulatory work that they should be doing. I don’t have much hope the politicians are going to deal with the real problems in our economies, it’s much easier to chase these phantoms and create this illusion of safety and of strange threats, and feed off the fear of people than it is to do things that are courageous and honest.

So we’re just going to do our thing. We’re going to build technology, and they can’t regulate ideas, and they can’t regulate mathematics, and they can’t regulate the open internet and they can’t regulate human communication, because those things are not under their control.

CryptoGlobe: Your talk earlier today at the CryptoCompare Digital Asset Summit focused a lot on the global access to finance through cryptocurrencies, what are your thoughts on the divergence between this goal and traditional finance building projects around cryptocurrencies? So, for example, JPM coin. What are your thoughts on that? Are these incompatible? Or can they achieve similar goals?

Antonopoulos: No, they can’t achieve similar goals for the same reason that we just talked about ‘Facebook coin.’ These are not cryptocurrencies, they’re taking the words and they’re emptying them of all meaning and they’re building systems to pretend to be, but they’re not cryptocurrencies. They’re not opening up portals. They’re not neutral.

They’re not censorship resistant. They’re not public. They’re not transparent. They’re not immutable. What they are, are tokens to the very same business as usual, the very same regular system that excludes billions of people from access to the world economy today.

We’re never going to achieve greater degrees of financial inclusion, as long as we insist on imposing these enormous requirements on participation in the economy by turning basic access to financial services into a privilege that is only available to those who have the identity, the literacy, the resources and means to fulfill these crazy requirements.

CryptoGlobe: Thank you so much for spending some time answering our questions.