Cryptocurrency mining hardware producer Bitmain has plans to issue an Initial Public Offering (IPO) in the U.S., after failing last year to list shares on the Hong Kong Stock Exchange (HKEX), Bloomberg reported today (June 21).

According to unnamed sources, Bloomberg said that Bitmain may attempt to raise between $300-500 million from issuing shares on U.S. markets, but that the number has not been finalized. The filling to the U.S. Securities and Exchange Commission should come next month, the unnamed sources said.

As CryptoGlobe reported late last year, the HKEX was tepid about listing companies working in the cryptoasset industry – including Bitmain’s competitor chip manufacturers.

Bitmain’s application to the HKEX officially lapsed during March of this year, which is also when co-founders Micree Zhan and Jihan Wu ceded their co-CEO duties over to Haichao Wang. Jihan Wu had been a notable personality on crypto social media, especially for his taking sides during the Bitcoin Cash forking drama.

Bitmain in 2019 – Looking Up?

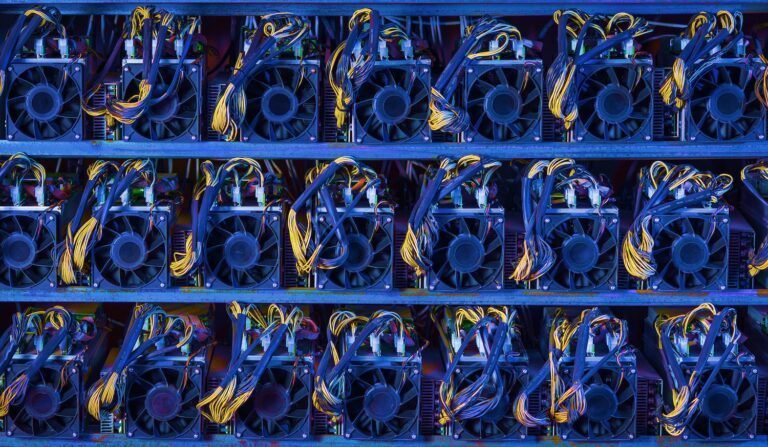

Although world’s foremost producer of Application Specific Integrated Circuit (ASIC) chips for cryptocurrency Proof-of-Work mining, it is safe to say that Bitmain had a troubled year during 2018, falling from grace during the bear market from one of the most profitable new crypto ventures of 2017 to a huge loss-maker.

According to anonymous sources speaking to Coindesk last year, Bitmain allegedly proffered innacturate pitch decks for would-be investors, falsly claiming to have raised capital from certain investors.

More recently, CryptoGlobe reported that Bitmain’s hashrate on the Bitcoin network (Bitmain also operates a large Bitcoin mining pool) had dropped almost 90% by May 2019.

Renewed signs of life Bitmain are appropriately timed, as the harsh “crypto winter” of 2018 seems to be sprouting the green shoots of crypto spring.