On Thursday (May 16), crypto exchange Poloniex, which was acquired last year by FinTech startup Circle, On Thursday (May 16), crypto exchange Poloniex announced that it plans to disable the markets for nine cryptoassets (that are currently listed on its platform) for its customers in the U.S.

The nine affected altcoins are Ardor (ARDR), Bytecoin (BCN), Decred (DCR), GameCredits (GAME), NEO Gas (GAS), Lisk (LSK), Nxt (NXT), OMNI, and Augur (REP); trading in these assets will be disabled on Friday, May29, at 16:00 UTC, for the exchange’s customers in the U.S. (this action will not affect those customers outside the U.S.).

Via a blog post published a short time ago, Poloniex explained that it was taking this action due to the lack of regulatory clarity in the U.S. market. More specifically, it seems that Poloniex does not want to get in trouble with the U.S. Securities and Exchange Commission (SEC) since these assets might be considered “to be securities.”

Poloniex says that it understands how “frustrating” this decision will be for its U.S. customers, but it had no choice since it is “committed to complying with regulatory requirements in every jurisdiction.”

All U.S. customers who have holdings in any of the aforementioned cryptoassets on Poloniex “must finalize all trades and close any positions in these assets prior to May 29th.” After the delisting in the U.S. takes place, these customers will still be able to “withdraw these assets from their wallet” for as long as these assets stay listed globally.

What is significant about this announcement is that is probably the first time that a crypto exchange has chosen to delist certain cryptoassets for a subset of its customers due to regulatory uncertainty over whether those assets are securities or not, but now that Poloniex has set the precedent, it seems more probable that in the near to medium term we will see other U.S. crypto exchanges (such as Kraken) take a similar action.

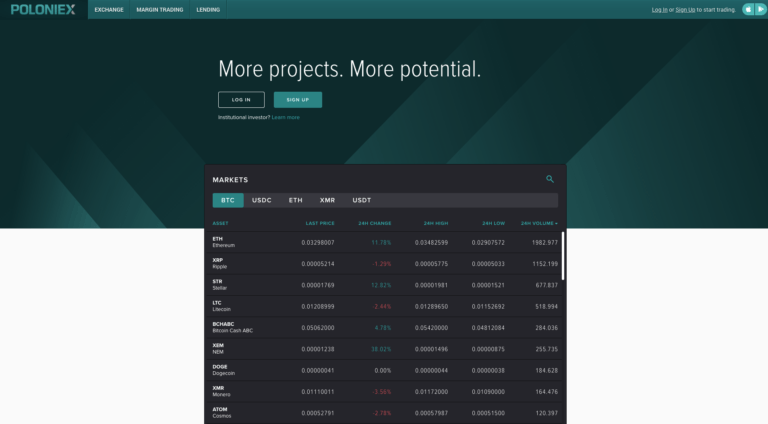

Featured Image Courtesy of Poloniex