ETHUSD Medium-term Trend: Bearish

- Resistance Levels: $230, $240, $250

- Support Levels: $150, $140, $130

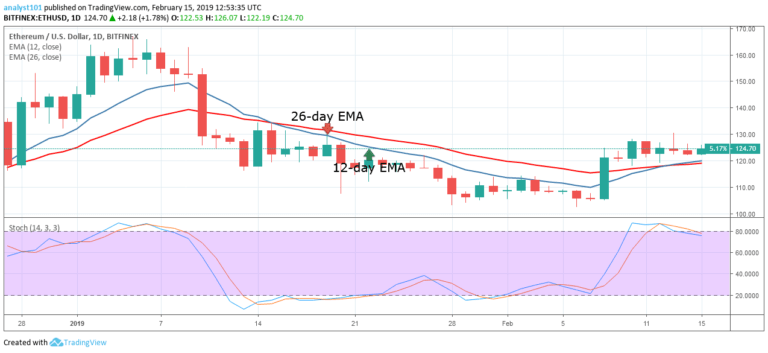

On April 18, the price of Ethereum was in a bullish trend. The bulls reached a high of $176 but could not sustain the price above the 12-day EMA. The bulls were resisted and price made a downward correction and fell to the $166 support level or at the 26-day EMA.

On the upside, if the 26-day EMA support level holds, the crypto’s price will resume its bullish trend to revisit the $170 and $176 price levels. On the other hand, if the bears break below the 26-day EMA, the price will fall to the $140 support level.

Meanwhile, the stochastic indicator is at the overbought region but below the 60% range, which indicates that the crypto’s price is in a bearish momentum, and is therefore a sell signal.

ETHUSD Short-term Trend: Bearish

On the 4- hour chart, the price of Ethereum is in a bearish trend. The crypto’s price fell to a low at $166. The bearish candlestick has been exhausted in the downward trend. The crypto’s price has resumed a bullish trend to break the bearish trend line.

Nevertheless, if a bullish candlestick breaks the trend line and another one closes on the opposite of it., the bearish trend is technically terminated. On the upside, if the bulls break above the EMAs, the crypto’s price will be in the bullish trend zone.

Meanwhile, the stochastic indicator is at the oversold region but below the 40% range, which indicates that the crypto’s price is in a bearish momentum, and is therefore a sell signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.