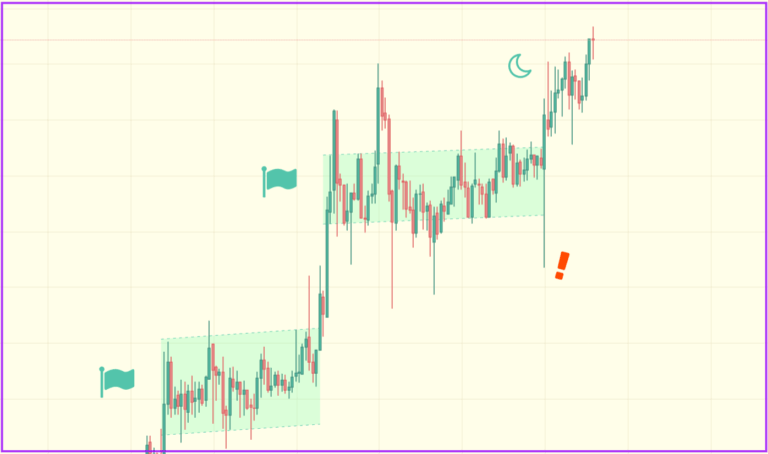

Bitcoin (BTC) has broken out of yesterday’s bull flag up to a slightly higher price level, but only after a sharp fakeout to the downside – presumably to clear stoplosses. This sort of reversal has become common in the last few days, after Bitcoin’s latest leg up and consolidation just under $4,100 on the USD pairing.

(source: TradingView.com)

(source: TradingView.com)

Bitcoin here is reaching two resistance zones: Both the top of the current uptrending channel, which has been respected since February; and the critical $4,100-200 support/resistance (S/R) zone that has been containing the leading crypto since late 2018.

And while we would probably all like to see Bitcoin break both of these critical levels (except you shorters!), it may be a hard struggle up. Certainly, more volume will be needed for further moves up. A correction back down to the bottom of the present channel would be reasonable, after so much gains during February and March.

(source: TradingView.com)

(source: TradingView.com)

A wider view of the market structure helps us see why $4,200 has become all-important. The entire structure is definitively an ascending triangle – a bullish pattern, which suggests an eventual breakout precisely at the $4,200 area.

Repeated retests of this level should eventually yield a breakout; but the present pattern extends out for quite some time, well into the summer months. A correction all the way back down to $3,600 would not be unlikely – nor would it be especially disastrous, as long as the price holds on the regional uptrend support.

(source: TradingView.com)

(source: TradingView.com)

On a much wider view of Bitcoin, we can see that the 2018 linear downtrend resistance has been more or less broken. If this trend break holds, it is a major accomplishment of the leading crypto, and is certainly the greatest piece of evidence for the bullish narrative. Sideways ranging, or even a gentle downward correction that remains above this downtrend line, would signal great news for the cryptoasset market.

(source: TradingView.com)

(source: TradingView.com)

(The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research)