Bitcoin (BTC) today maintains its slow uptrend, after several rounds of stiff defense of the shocking 2 April breakout.

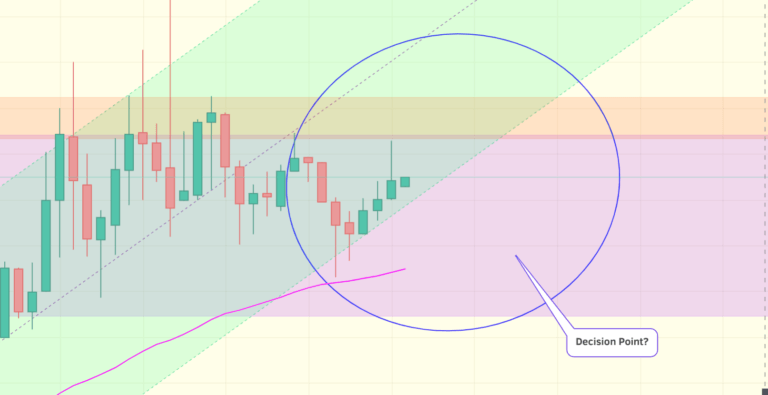

Support/resistance (S/R) zones that have defined BTC’s new post-April market structure, are now being slowly eaten away by an uptrending channel (green, below) rather than abrupt launches.

Any dips to threaten these zones have so far only briefly managed to pierce the 55 hour exponential moving average (EMA, pink below). However, the area at about $5,040 seems to have formed a solid resistance level for the leading crypto.

These three factors – the uptrending channel, the 55 EMA, and the $5,040 ceiling – are together squeezing price into a potential decision point.

(source: TradingView.com)

(source: TradingView.com)

On a slightly larger timescale, Bitcoin’s shocking breakout, and the movements that have followed it, are coming to strongly resemble a bull flag pattern – which suggests another break up. Although this may seem unthinkable after getting so much upside, Bitcoin has already defended two aggressive selloffs, and has established a local uptrend.

(source: TradingView.com)

(source: TradingView.com)

Taking a look at the daily timeframe, we can see all the features of the new market structure contained between $4,200 and $6,000-ish. Bitcoin’s highest rejection came squarely in the middle of a S/R zone, at $5,345 on the Coinbase chart. A retest of this zone could weaken and begin to break it.

Alternatively, should Bitcoin decide to take a much-deserved correction, holding the $4,600 mark – where the important 200 day moving average (MA) lies – would be ideal and cause for continued optimism for the medium term. Failing holding this level, there is a decent knot of support screening the critical $4,200 point.

A return to $4,200 would probably invalidate the thesis, proffered by many analysts now, that the 2018 bear market / “crypto winter” is truly over. A successful retest of the 200 MA, in fact, would be very healthy and a boon to market confidence.

(source: TradingView.com)

(source: TradingView.com)

(The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.)