BTCUSD Medium-term Trend: Ranging

- Resistance levels: $7,000, $7,200, $7,400

- Support levels: $5,200, $5,000, $4,800

Last week the BTCUSD pair was in a bullish trend zone.The bulls reached a high above the $5,600 price level and were resisted. The price fell to a low at $5,215.60 and resumed its bullish trend. This week the price levels to watch are the $5,200 and $5,400 price levels.

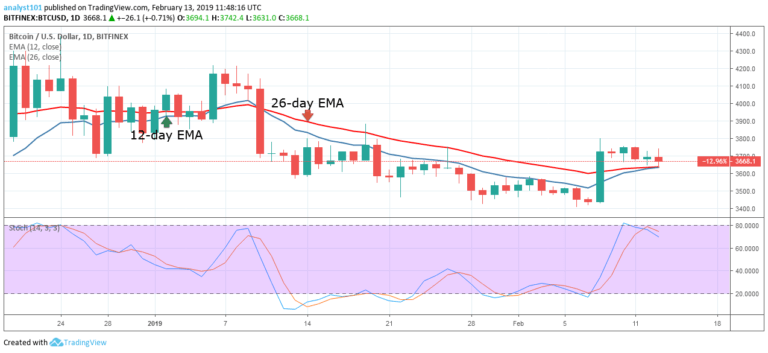

Since April 2, the crypto’s price had been trading in the bullish trend zone. The crypto’s price had been trending above the 12-day EMA and the 26-day EMA indicating that the price is likely to rise. This week the crypto’s price is likely to retest the $5,650 resistance level if the price is sustained above the EMAs.

On the downside, if the bulls fail to break the $5,650 resistance level, the crypto’s price will fall. And if it falls and breaks the $5,400 price level, the BTC price will find support at the $5,200 support level. Nevertheless, if the $5,200 support level is broken, the crypto’s price will be in a downward trend. Meanwhile, the stochastic indicator is at the overbought region but above the 60% range which indicates that the crypto is in a bullish momentum and a buy signal.

BTC/USD Short-term Trend: Bearish

On the 4-hour chart, the price of Bitcoin was trading above the $5,400 price level. On April 25, the bears broke the $5,400 but found support at the $5,200 price level. The price made an upward correction to reach the bullish trend zone. The crypto’s price is trading above the 12-day EMA and the 26-day EMA but it is facing resistance at the $5,545 price level.

On the downside, if the bears break the $5,400 price level, the crypto’s price will fall to the bearish trend zone. Meanwhile, the stochastic indicator is at the overbought region but below the 80% range which indicates that the crypto is in a bearish momentum and a sell signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.