Spanish bank Santander has recently clarified via microblogging platform Twitter that it isn’t using the XRP cryptocurrency for international payments, but is instead using a product developed by Ripple, the firm behind the token.

Santander’s clarification came shortly after it mistakenly told a Twitter user who asked whether it was using XRP that it was using the cryptocurrency for “international payments to 18 EU countries and the USA” through its One Pay FX app.

Given the attention the tweet received, Santander clarified the very next day it was a misunderstanding, and that its One Pay FX app uses Ripple’s xCurrent technology, and not the XRP token.

We are sorry, unfortunately due to a misunderstanding we have given incorrect information. We do apologise for the confusion this has caused. One Pay FX uses xCurrent only. You can find out more here: https://t.co/EGWMMqZhkA.

— Santander UK Help (@santanderukhelp) March 24, 2019

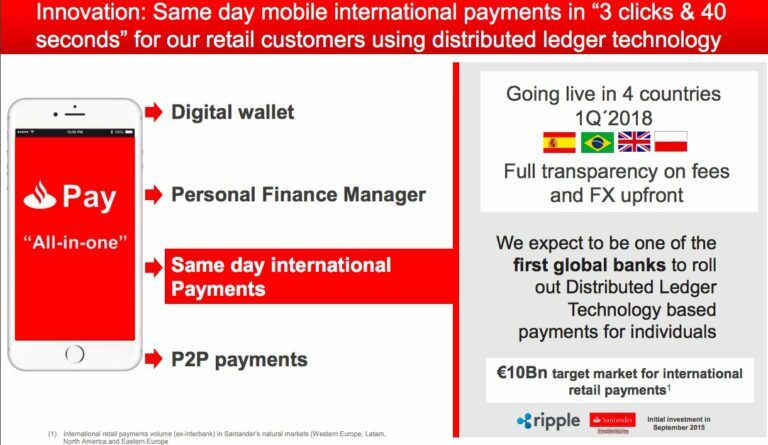

In its tweet Santander linked to a press release from last year, in which it revealed it was going to use blockchain-based technology to conduct international transfers for clients “on the same day in many cases or by the next day.” Per the document, Santander was the first bank to “roll out a blockchain-based international payments service to retail customers in multiple countries simultaneously.”

As CryptoGlobe covered in March of last year, the Spanish bank partnered with Ripple to launch the One Pay FX app, which is said to rely solely on Ripple’s xCurrent and RippleNet products, not XRP. The app’s users aren’t just able to see their transactions get settled in a short amount of time, they’re also able to see how much each transfer will cost.

One Pay FX was initially available to users in Spain, the UK, Brazil, and Poland. Over time, Banco Santander revealed it was set to roll it out to more countries throughout the world. Notably, Santander has invested in Ripple back in 2015 and 2016.

Last year, Ripple formed various partnerships to see financial institutions use its products. Among them was MoneyGram, with the goal of speeding up fiat currency settlements. It also joined a consortium of 61 Japanese banks to create an instant payments app.