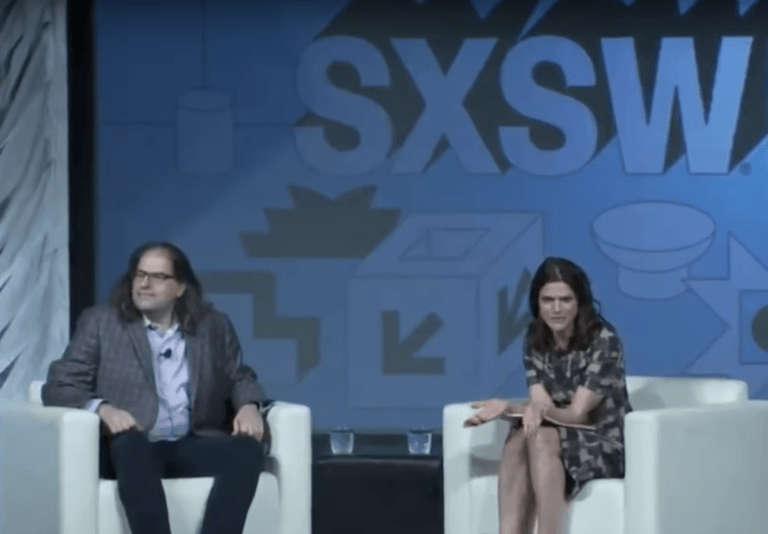

On Thursday (March 14th), David Schwartz presented his thoughts on a wide variety of topics at a featured session called “Blockchain Beyond the Hype: The Ripple Effect” at the SXSW 2019 Conference in Austin, Texas.

David’s comments during an interview with Sarah Silverstein, who is Editor-at-large and Executive Producer at Business Insider. Here are some of the main highlights from this interview:

- David discovered Bitcoin in 2011. It was “love at first sight.”

- He fell in Bitcoin because there was no need for a “central operator” (or “central point of trust”).

- Although a lot of people in the Bitcoin community thought that Proof-of-Work (PoW) was the “magic element” in Bitcoin, what Jed McCaleb, David Schwartz, and a few other people realized was that the “secret sauce” of Bitcoin was that “all the state information is public,” and that PoW was just a solution for the double spend problem.

- Today, the primary use case that Ripple sees for the XRP Ledger is settling cross-border cross-currency payments because it is “really, really good at that.”

- Over the long run, he expects the price of XRP to be tied to “the success of the ecosystem,” but he is not sure if price necessarily follows “rational expectations.”

- His pet peeves about blockchain and crypto (i.e. things about these two topics that he thinks are most commonly misunderstood): that many people think the price of a coin/token is a good metric for the success of a crypto project; that some people believe in the idea that blockchains are “very expensive” and can never be “competitive with coventional databases or applications”; and the fact that some people do not seem to realize that “certain types of attacks are fundamentally impossible on blockchains.”

- He believes that what all decentralized systems have in common is that “they don’t have any party who can coerce other parties to accept the rules.”

- Although SWIFT gpi “does addresses some of the pain points that people had,” he feels that the main problem with it is that “it does not enable settlement at the time of payment.”