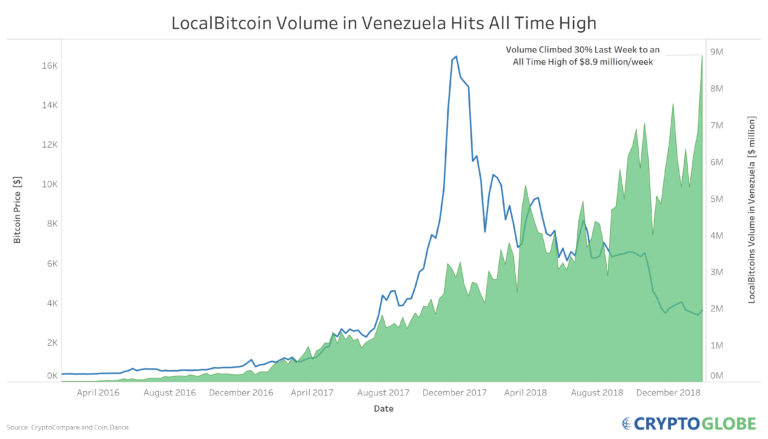

In the last week, the amount of Bitcoin traded by Venezuelans via the LocalBitcoins peer-to-peer platform exploded by 30%, to reach an all-time high.

The trading by residents of the financially troubled country, whose native Bolivar has been devalued by long-term hyper-inflation, amounted to the equivalent of $8.9m over the seven days up to February 8th.

The news comes in the wake of the weekend announcement of new restrictions on the trading of cryptocurrencies for residents of Venezuela by its government, with the South American country’s authorities – which themselves have sought to raise funds to for ailing, sanction-blighted, economy through the issuance of its own cryptocurrency, the Petro – placing a levy of up to 15% on all cryptocurrency-based remittances.

Such transactions will also be limited to the equivalent of just $600 per month – a limit that relies on the government’s own valuation for of fiat value of 10 Petros per month, which effectively means the government, not the market is setting the value for the little-seen-much-debated, controversial, coin.

As if to point out just how important the cryptocurrency is becoming to the economy of the beleaguered country, one Twitter user highlighted the fact that LocalBitcoins was currently trading at volumes 157-times that of its largest stock exchange. Kevin Rooke’s (@kerooke) tweet shows a message saying the Caracas exchange “presented a total volume of 26,585,787 Bolivar on February 8th. That may sound a lot, but equates to just says, did $8,117 of trading volume on – by contrast, $1.28m-worth of cryptocurrency changed hands via Local Bitcoins.

Venezuela's P2P Bitcoin market does 157x the volume of their largest stock exchange.

Venezuela's top stock exchange did $8,117 of trading volume on Friday.

Not a typo. $8,117 USD.

Venezuelans traded an avg of $1.28M of Bitcoin on LocalBitcoins each day this week. pic.twitter.com/Uu4Ed2B9V3

— Kevin Rooke (@kerooke) February 11, 2019

Venezuelans Prefer Bitcoin to the Petro

While a recent report on the Petro alleged that there was little evidence of the government issued cryptocurrency being in use in Venezuela, its residents have increasingly turned to Bitcoin as an effective way of insulating their assets against the rigours of the hyper-inflationary conditions prevalent in the country.

Ironically, given Bitcoin’s considerable losses in value during the course of 2018, it seems to have remained an attractive option for those with the ability to transfer assets – a move for which the peer-to-peer trading platform LocalBitcoins appears to have become one of the main forums. Indeed, even as the price of Bitcoin has more than halved, the monetary value of transactions by Venezuelans has now more than doubled since points in August 2018.