On Wednesday (January 30th), day two of Paris FinTech Forum 2019, Ripple CEO Brad Garlinghouse and SWIFT CEO Gottfried Leibbrandt had a debate at a panel called “Let's Send the Money”, which was about the future of cross-border payments. This article covers the main highlights from this exciting and important debate.

The panel was moderated by Elizabeth Schulze, a Technology Correspondent for CNBC International. Schulze started by asking the SWIFT CEO why SWIFT was the future of cross-border payments.

The SWIFT CEO said that there were two reasons:

“First, because we have 10,000 banks in the network, and that, I think, is a resilient system, correspondent banking, and the other reason is [that] we are innovating like crazy… The big innovation we introduced three years ago called GPI, Global Payments Innovation, which really takes correspondent banking into the 21st century. Essentially, we introduced a unique identifier for each payment so you can now track your payments all the way through. We provided a set of rules for speed, and we provided transparency on the pricing. That has greatly enhanced the experience for customers — that’s what it’s all about. I was in China the week before last, and the Chinese banks told me ‘every payment we now send to the U.S. is there within minutes; so, it’s nice that you have tracking, but now cross-border payments has really improved. The same for corporates: you can now track it, etc…

… and I think the other great news is that we already have the network, we can roll it out, make it backward-compatible, etc. So, we now have more than half of the payments globally on that new platform. Most of those arrive within half an hour, end to end, customer to customer. We’ve signed up over 400 banks, all of the top 60 are on there, and we are looking towards general adoption in a year and half, and then the whole of correspondent banking will be on that new platform… and with that, you get all the benefits of the existing model — bank-centric, deep liquidity, with all the controls that banks have built around KYC, sanctions screening, and the whole of the compliance controls that go with it. So, I am extremely excited about it… I don’t think we could have done this without competition making it clear to banks that they need to shape up their acts that we did jointly with them. We could also not have done it without technology…”

The Ripple CEO responded by describing the idea of “internet of value”. He then said that he saw the dynamic between Ripple and SWIFT not dissimilar to the dynamic between Amazon in 1997-1998 and Walmart, calling it a “David and Goliath” kind of story. He later said that although SWIFT’s GPI represented a big step forward for the traditional correspondent banking model, it was like trying to make a “horse and buggy” go faster when you could just “move to a Ferrari.”

Schulze then reminded Garlinghouse that he had in the past said that Ripple would take over from SWIFT in the area of cross-border payments. Garlinghouse replied:

“Well, I have also said that there are ways we can work with SWIFT.”

Schulze asked Leibbrandt how he felt about a partnership with Ripple, to which he replied:

“… I don’t see the role of banks going away if they innovate fast enough… One of the exciting things about the new GPI platform is the fact that it is extremely interoperable and open, and we’ve always had links to other networks. We are going to enhance that with API access. We are announcing later today a Proof-of-Concept with R3… where you can initiate a payment on the trade platform and that goes into GPI. So, we are exploring interconnectivity with a lot of things… To some extent, you can already do that. Right now, Santander is on SWIFT as well, so they can act as the peering point between the two networks… I firmly expect that within a few years GPI will be de facto real-time cross-border.”

Schulze next asked the SWIFT CEO why not use Ripple’s technology to do that (rather than wait a few years). Leibbrandt answered:

“We had a long discussion about blockchain vs. API… Blockchain, we think is further out. We’ve run a big Proof-of-Concept with blockchain, several Proof-of-Concepts I should say, one of them to put it inside the reconciliation between banks, nostro vostro. We had 40 banks participate in that. It was the largest Hyperledger implementation outside IBM… But when we evaluated it with the banks, they said ‘that works a proof-of-concept, but it is not clear to us that it is that much better than what we have today given the migration cost’. We find that for them it is much easier to integrate with APIs and what we are now offering with GPI than it is with blockchain.”

When asked what he thought about Leibbrandt’s answer, Garlinghouse replied:

“When we think about internet of value, it’s not just about the banks… I think it’s fundamentaly kind of a different view of how the world may play out.”

The SWIFT CEO than touched on the potential use of XRP by banks:

“The banks are hesitant to convert things to a cryptocurrency right now because of the volatility in the currencies, because you don’t have the deep liquidity that you have in, for example, the dollar… We don’t find them ready for a model where you convert into crypto and then convert it back, and that has to do with many things…”

The Ripple CEO challenged Leibbrandt’s answer, which he felt contained some misinformation:

“SWIFT today is a one-way messaging framework. It isn’t actually a liquidity provider… When we think about internet of value, it’s a mixture of two-way messaging frameworks… coupled with real-time liquidity… I hear people talking about volatility, and I feel they are propogating misinformation… If you take a low volatility asset [fiat] times a long duration vs. a high volatility asset [crypto] for a very short amount of time, it turns out that mathematically there is less risk in the XRP transaction than in the fiat transaction.”

On 5 December 2018, enterprise blockchain software firm R3 announced the launch of its new Corda Settler app, which allows payment obligations arising on the Corda blockchain platform “to be made through any of the world’s payment systems, both traditional and blockchain-based,” with XRP as the first (and currently only) cryptocurrency that is supported as a settlement mechanism.

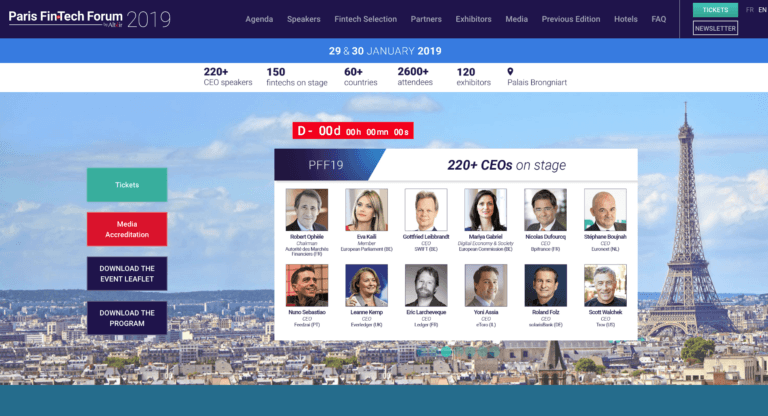

Featured Image Courtesy of Paris FinTech Forum