Michael Novogratz, the CEO at Galaxy Digital Holdings Ltd, has reportedly acquired an additional 7.5 million ordinary shares of the merchant banking institution for approximately $5.5 million.

Novogratz, who graduated from the prestigious Princeton University in 1987, now owns nearly an 80% share in Galaxy Digital Holdings, a New York-based company focused on digital assets and the blockchain technology industry. Notably, the former partner at Goldman Sachs has bought about 2.7% of issued and outstanding shares in the Toronto Stock Exchange (TSX) listed firm at a time when cryptoasset prices have not shown any signs of recovering..

Established in early August 2018 through a merger with a Canada-based shell company via a reverse takeover, Novogratz had remarked (at that time):

If I knew what I know now, knew the crypto markets were going to swoon as much, and it was going to take so long, I might have stayed private for another year or so and then gone public. But I don’t think it’s a mistake.

Merging With Shell Company To Launch Galaxy Digital

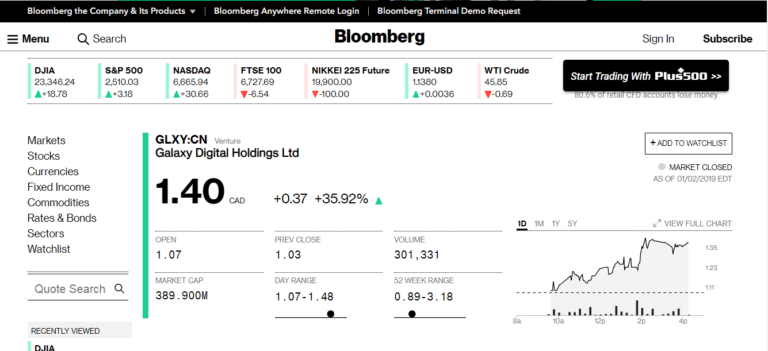

Conducting a US initial public offering (IPO), instead of the merger, would not have been possible as Galaxy Digital LP does not have the required minimum two years of audited financial history. Following the announcement that Novogratz had acquired more shares in the company he founded, the Galaxy Digital stock price surged 36% to $1.40 CAD (appr. $1.03). In 2018, the firm’s shares fell by 19% and the merchant bank’s net income at the time of writing stands at -$19.3 million CAD (appr. -$14.2 million).

As noted by Bloomberg, before purchase, Novogratz owned “213.7 million Class B limited partnership units” which accounted for roughly “76.6% of ordinary shares assuming conversion.” After purchase, Novogratz “owns and controls 221.2 million ordinary shares” which represent around “79.3% of ordinary shares assuming conversion.”

Novogratz: Q1 & Q2 Will Be Very Bullish For Bitcoin

As CryptoGlobe reported in mid-October 2018, Novogratz had said that Q1 and Q2 of 2019 will be extremely positive for bitcoin (BTC), the flagship cryptocurrency. Specifically, the Wall Street veteran had noted that Fidelity Investments, one of the world’s largest financial services providers with over $7.2 trillion of assets under management (AUM), had become the first major established financial institution to officially announce a crypto custody solution. This, according to Novogratz was a very bullish development for bitcoin and the crypto industry.

Notably, the Galaxy Digital CEO had called a bottom for the bitcoin (BTC) price in September 2018 when the world’s most dominant digital currency was trading in the $6,400-$6,500 range. However, the BTC price dropped considerably, starting in mid-November 2018 as it fell below the $6,000 mark and continued its decline to currently around $3,900 at press time.