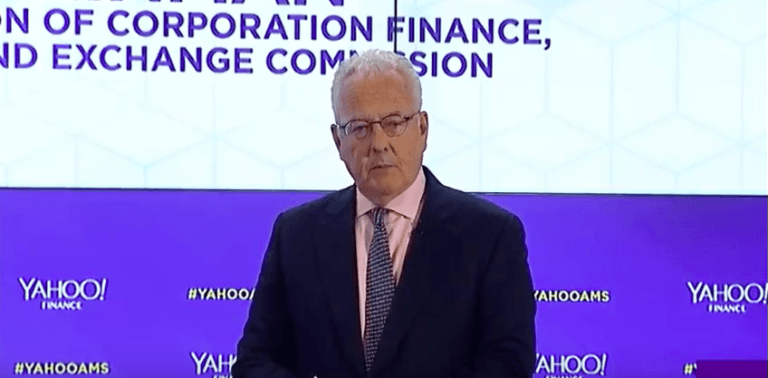

At the recent Fintech Week Conference in D.C, William Hinman, director of Corporation Finance for the U.S. Securities and Exchange Commission (SEC), announced that the agency will finally be issuing “plain English guidance” on ICOs.

The guidelines from the SEC will reportedly help developers figure out whether or not their project is classified as a security or not, which will ultimately determine how the token is regulated. At the event, Hinman:

“We also will be putting out more guidance, the idea is a plain English instrument that people can look at and they'll bring together sort of my Howey-meets-Gary speech, and that analysis … We'll elaborate on that in a very plain English way, so 'do I think I have a security offering,' look at that guidance and you should be able to sort things out.”

Hinman said that developers will need to submit their projects through the SEC’s new FinHub division, which decide if it will be regulated as a security. Hinman added that:

“Once you determine whether you have a security, we're going to have in that guidance, 'how do I go about registering' and 'how do I go about doing an exempt offering. I think we can try to bring that together and share that … we want to share that a little bit more transparently.”

Under the SEC’s guidelines, many of the blockchain projects currency on the market could be considered a security. Hinman clarified that:

“If someone's offering an instrument for money or other consideration to a third party, and that third party expects the offerer to generate a return or so something that will increase the value of the coin or token or whatever they want to call it, and there's that expectation of return, we're generally going to see that as a securities offering.”

Industry Waiting For Clarity

As CryptoGlobe reported in September, more than a dozen members of congress sent a letter to the chairman of the Securities and Exchange Commission (SEC) Jay Clayton, asking the agency to present a clear picture of how it views cryptocurrencies and other digital assets.

For years, lack of clarity from regulatory agencies has left many developers and traders nervous about the future of their favorite projects. Lack of regulatory clarity is also one of the primary factors that is keeping institutional investors from bringing their money into the space – as they wait on the sidelines to see how this new asset class unfolds.

This has been such a prevailing theme that many crypto investors have predicted a massive bull run once the regulatory framework is in place, as the traditional financial institutions will feel more comfortable entering the market.