South Korean cryptocurrency Bithumb has recently claimed to have regained the title of number one cryptocurrency exchange in the world on social media. A close look at its platform seems to show it’s seemingly incentivizing wash trading and other schemes.

Bithumb’s trading volume has indeed, according to available data, surpassed that of other leading exchanges like Binance, OKEx, and Huobi. It’s risen so much that according to CryptoCompare’s October 2018 Exchange Review, the South Korean Won (KRW) became the third largest fiat currency traded against BTC after the exchange saw a 230% increase in volume. Bithumb has seen its volumes rise even higher, peaking at $2.37 billion on November 5th.

Busy Year for Bithumb

Interestingly, Bithumb was hacked in June of this year, and saw hackers steal 35 billion KRW ($31.5 million) from its wallets. At the time it was forced to freeze deposits and withdrawals and only reopened them in early August.

While the security incident likely affected traders’ confidence in using the exchange’s platform, it still raked in $35.3 million in the first half of this year. The exchange, last month, saw BK Global Consortium, a blockchain investment company established by Singapore-based medial surgery group BK Global, acquire a majority stake in it.

Shortly after, Bithumb launched its decentralized exchange (DEX). But things at Bithumb had started getting increasingly strange earlier this year. As economist and crypto analyst Alex Krüger pointed out, the exchange was seeing up to $250 million worth of fake trading volume in September, as it was offering users a 120% payback on all trading fees.

Using the payback, users were essentially wash trading against themselves to collect the extra 20% the exchange was paying out, while artificially pumping its trading volumes. While there was a payback limit per day, some users were taking advantage of the promotion.

Bithumb's promotional wash trading still ongoing. $150K/day of free money. Nice. https://t.co/pUvOuqzuN3

— Alex Krüger 🇦🇷 (@Crypto_Macro) September 11, 2018

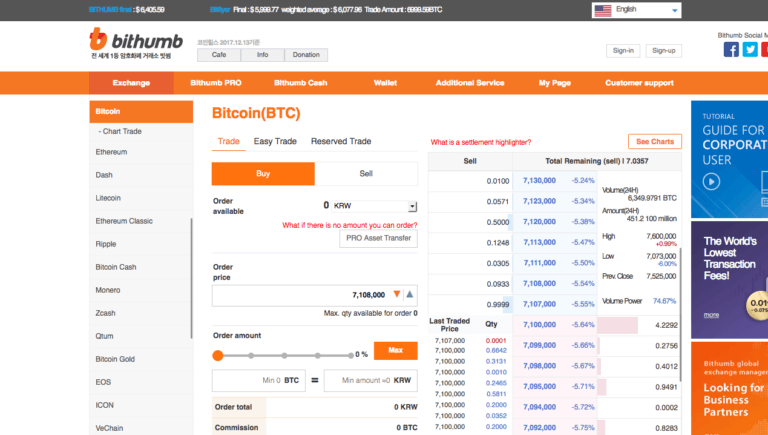

Currently, Bithumb’s website shows it has a 70% discount on fees, which would curb this strategy while making it attractive for traders to use the platform. Despite the development things at the platform aren’t looking natural.

Large Trading Volumes and Unstable Markets

Notably Business Korea recently reported that Bithumb was under fire after data aggregators noticed its ongoing promotions were “generating a considerable amount of transactions” that could “create market confusion by raising variability of cryptocurrency prices,” as they incentivize investors to speculate.

While its 120% fee payback promotion is now over, the exchange is notably still airdropping coins to traders who, taking advantage of large fee discounts, trade over a specific amount. Per Business Korea, some say it’s “using its monopoly status” to inflate its volume. Responding to the controversy, Bithumb was quoted as saying:

We have never inflated the volume of transactions. It is not easy to estimate the actual transaction volume by calculating the effect of promotion events separately and it is difficult to accurately measure the volume of transactions based on data of one counting website.

In CryptoCompare’s report Bithumb had the second highest average trade size across all major cryptocurrency exchanges of $2,750. Looking at the charts, it seems to show large orders are made and quickly filled in short intervals.

This type of pattern would be consistent with wash trading as those trying to trade against themselves wouldn’t try to enter large orders without making sure the market could absorb them without slippage.

Taking a look at Zcash, for example, shows how much volumes can be being inflated. According to CryptoCompare data the cryptocurrency is currently mostly being traded against the KRW, and 99.96% of its trading volume is coming from Bithumb, where over $400 million worth of ZEC have traded hands in only 24 hours. Despite the incredible trading volume, ZEC’s price has remained relatively stable, as it only rose 0.3% in the last 24 hours.

Unstable Order Books

An order book is an electronic list of buy and sell orders organized by price level and the review analyzes the order book depth to determine the stability of each exchange. The chart below shows the average 10% order book depth to average 24 hour volume ratio. In other words – the ratio shows what percentage of daily trading volume it would take to move the market price down by 10%. The smaller the ratio the easier it is to pump or dump the markets.

CryptoGlobe analyzed Bithumb’s order books which shows how unstable the markets have become, looking at the chart below it would take only 0.008% of the daily trading volume of XMR/KRW and ZEC/KRW to drop the price of these markets by 10%.

To put the 0.008% in perspective, it would take 46% of the daily trading volume on Coinbase’s top 5 pairs to drop the price on these markets by 10%. Bithumbs top 7 pairs have a average ratio of 3% which is one of the lowest ratios in the crypto exchange industry (see CryptoCompare's October Exchange Review), similar to that of Trans-Fee Mining Exchanges.

Bithumb’s decentralized exchange seems to also be seeing strange activity. It’s current top trading pair, CXTC/ETH reportedly saw over 25,000 ETH change hands on it, although available data shows CXTC’s total trading volume against the second-largest cryptocurrency was of only 310 ETH on other platforms.

‘Today’s Coin’

Bithumb, often publishes a “today’s coin” post on social media, in which it lets its followers know which cryptocurrencies surged on the platform. The last two coins the exchange posted about were Steem and Augur (REP).

Steem, traded against USDT on various exchanges including Bittrex and Poloniex, is averaging $0.795 after falling 1.77%. On Bithumb, however, it’s up over 40% after its volume skyrocketed on the platform.

CryptoGlobe has reached out to Bithumb for comment. We will update this piece once we hear back.

Focusing on Privacy

Looking at the most popular cryptocurrencies on Bithumb shows those responsible for its incredible trading volume are seemingly, by far, interested in cryptocurrencies that can grant them a certain degree of anonymity, as XMR, BTC, and ZEC are currently leading in trading volume.

The cryptocurrency exchange’s website doesn’t seem to show there’s a promotion going on for any of these cryptocurrencies, which could imply the traders are picking these cryptos because of their privacy-centric features. Curiously, South Koren regulators have cracked down on anonymous crypto trading,

The connection between the ban and the focus on privacy coins, if any, is currently unclear. What’s clear is that while Bithumb may have managed to become the number one cryptocurrency exchange by trading volume, trading on the exchange can be a risky endeavor.