On Tuesday (20 November 2018), Kelly Loeffler, the Chief Executive Officer of Bakkt, a subsidiary of the Intercontinental Exchange (ICE), announced that the launch date for the Bakkt platform, which offers a physically-settled Bitcoin (USD) Daily Futures Contract, has been changed from 12 December 2018 to 24 January 2019, and explained the reasons for this delay.

Loeffler started by noting that her team has been “hard at work with customer onboarding and securing regulatory approvals.” With regard to the latter, she said that they are continuing “to work closely with the CFTC as they conduct their thorough review of the Bakkt™ Bitcoin Daily Futures contract and the Bakkt Warehouse.” Furthermore, she points out that these products “represent a critical shift in the evolution of crypto markets toward more accessible, useful, and regulated instruments.”

Next, the Bakkt CEO stated that due to “the volume of interest in Bakkt and work required to get all of the pieces in place,” the new launch date will be 24 January 2019 to ensure that everything is ready on launch day:

“As is often true with product launches, there are new processes, risks and mitigants to test and re-test, and in the case of crypto, a new asset class to which these resources are being applied. So it makes sense to adjust our timeline as we work with the industry toward launch.”

Then, she explained that they were planning to expand their offering (details of which would be announced “in the coming weeks”), but she was able to announce that they have managed to get “insurance for bitcoin in cold storage,” and that they are “in the process of securing insurance for the warm wallet within the Bakkt Warehouse architecture.”

Loeffler also took this opportunity to answer a few frequently asked questions about their platform.

For example, on the question of why they were starting with Bitcoin and when other cryptocurrencies would be supported, she gave this answer:

“Bitcoin today accounts for over half of total crypto market capitalization and has been deemed to be a commodity, and its derivatives are regulated in the US by the CFTC. As the world’s most liquid and widely distributed cryptocurrency, and where we’ve seen the most customer demand, bitcoin’s profile creates a liquid product on which to build a futures contract. We’ll consider additional contracts as the landscape evolves and as we receive additional customer feedback about what they want and need.”

Another interesting question that she answered was how the price of Bitcoin was going to be established:

“Given the transparency and regulation of the futures markets, the futures price in a one-day physically settled bitcoin contract will serve as a price discovery contract for the market. There is no reliance on cash platforms for settlement prices for pricing the daily bitcoin futures contract.”

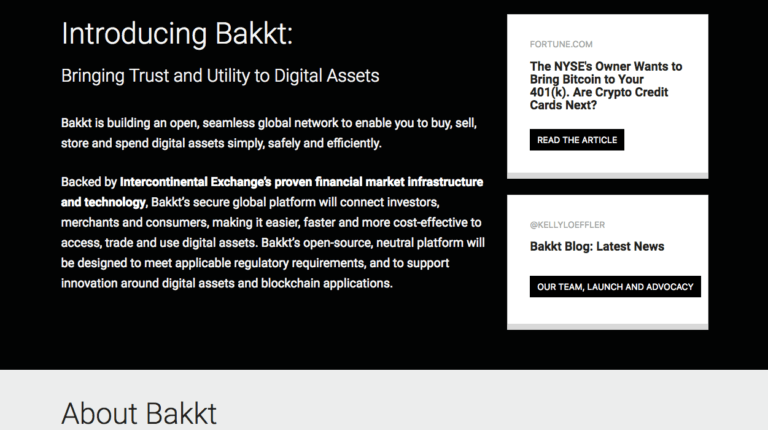

Featured Image Courtesy of Bakkt