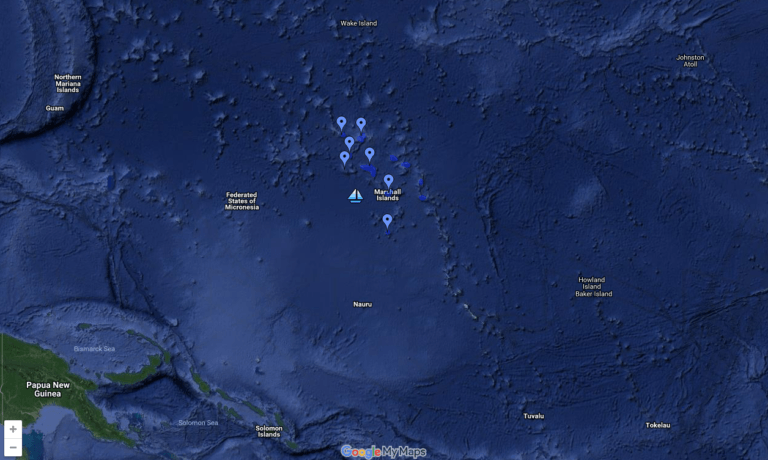

On Monday (5 November 2018), eight senators introduced a vote of no confidence in Hilda Heine, the President of the Republic of the Marshall Islands, which is an island nation (comprised of more than 1,100 islands and islets) near the equator in the Pacific Ocean. The vote has been scheduled to take place on November 12th (since the Marshallese constitution requires a vote to be held five to ten days after a no confidence motion has been lodged).

It all started back in February 2018, the same month that the government of Venezuela launched its own (oil-backed) cryptocurrency (called the Petro) as a means of escaping U.S. sanctions. As reported by Bloomberg, in late February, members of the Marshallese parliament (Nitijela) voted to proceed with a plan to create a national cryptocurrency called the Sovereign (SOV) that would serve as a second official form of legal tender (along the U.S. dollar). David Paul, minister-in-assistance to the president, told Bloomberg in a phone interview that the government would “arrange an initial coin offering and exchanges will be allowed to apply to trade the currency,”

On 26 February 2018, the country passed the “Declaration and Issuance of the Sovereign Currency Act 2018”, the purpose of which was “to declare and issue a digital decentralized currency based on blockchain technology as legal tender”. The bill stated that this new cryptocurrency, called the Sovereign (SOV), would be issued by the Ministry of Finance and introduced via an initial coin offering (ICO).

Then, on 10 September 2018, the International Monetary Fund (IMF) released a 58-page report in which it warned the Republic of Marshall Islands (RMI), a small sovereign island nation in the Pacific Ocean, not to go ahead with the plan to launch of SOV, saying that using crypto as a second form of legal tender would be risky:

“The issuance of a decentralized digital currency as a second legal tender would increase macroeconomic and financial integrity risks, and elevate the risk of losing the last U.S. dollar correspondent banking relationship.”

The IMF report went on to say that the potential costs of this plan far outweighed the potential benefits:

“The potential benefits from revenue gains appear considerably smaller than the potential costs arising from economic, reputational, AML/CFT, and governance risks. In the absence of adequate measures to mitigate them, the authorities should seriously reconsider the issuance of the digital currency as legal tender.”

According to Radio New Zealand, at yesterday’s session of parliament, Senator Casten Nemra, a former president of the Marshall Islands, had several criticisms of the Heine administration, the most notable being that “the plan to establish a digital currency as legal tender had tainted the country’s reputation and generated criticism from major financial organizations, including the International Monetary Fund and the US Treasury Department.”

Featured Image via “Google My Maps”