On Friday (5 October 2018), Robinhood, the Californian FinTech startup, founded in 2013, which launched a zero-commission crypto trading service (“Robinhood Crypto”) in February, announced that the service had now become available in two more U.S. states: Arkansas and Tennessee.

The Robinhood mobile app lets U.S. customers (mostly millennials) trade cryptocurrencies, stocks, ETFs, and options commission-free (and with no minimum investment) all within one app.

When Robinhood Crypto first launched in February 2018, the only two cryptocurrencies supported that you could trade were Bitcoin (BTC) and Ether (ETH); also, the service was only available in four states. By 12 July 2018, as reported in the Robinhood blog, support for trading two more cryptocurrencies — Litecoin (LT) and Bitcoin Cash (BCH) — had been added, and the service had expanded to 17 States (AZ, CA, CO, FL, IN, MA, MI, MS, MO, MT, NJ, NM, PA, TX, UT, VA, and WI).

July 16th and August 6th saw Robinhood add trading support for Dogecoin (DOGE) and Ether Clssic (ETC) respectively. As for expansion of the service to other U.S. states, since July 31st, the service has become available to customers in 7 more states: Iowa (July 31st); Georgia (August 2nd); ; Alaska (September 25th); Oklahoma (September 27th); Rhode Island (October 2nd); Arkansas and Tennessee (October 5th).

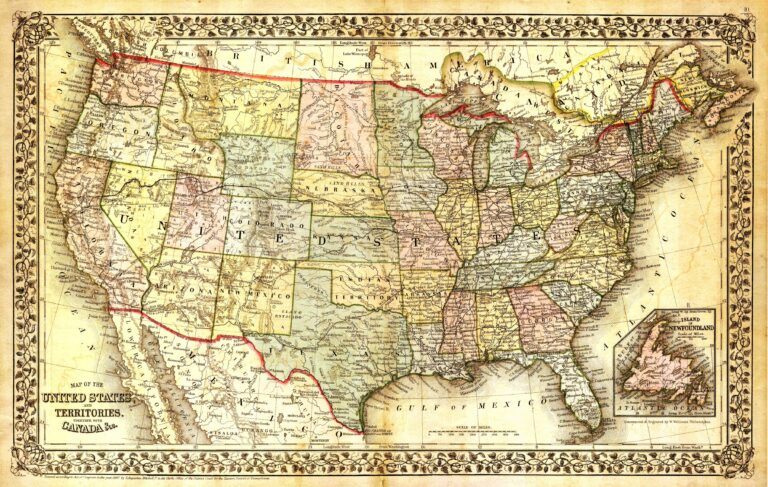

This means that the Robinhood Crypto service is now available in 24 states: Alaska, Arizona, Arkansas, California, Colorado, Florida, Georgia, Indiana, Iowa, Massachusetts, Michigan, Mississippi, Missouri, Montana, New Jersey, New Mexico, Oklahoma, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, and Wisconsin.

Robinhood makes money in the following ways:

- Earning interest on funds held in customer accounts.

- Selling order flow to exchanges wanting additional liquidity.

- Selling subscriptions to “Robinhood Gold”, which costs $10 – $200 per month, and allows margin trading.

In early May 2018, Baiju Bhatt, Robinhood co-founder and co-CEO, told CNBC on a phone interview:

“In the next couple of years, I think you'll see Robinhood looking like a full-service consumer finance company.”

Featured Image Credit: Photo via Pexels.com