On Tuesday (16 October), CryptoCompare, a leading global provider of cryptocurrency market data, released its “Cryptoasset Taxonomy Report 2018” which surveys the cryptoasset landscape, and looks at various ways in which such tokens can be categorized. This article focuses on the part of the report that presents a novel taxonomy that reflects what CryptoCompare sees as “the most natural grouping of cryptoassets at this moment in time.”

But before start, it is useful to present CryptoCompare’s definition of “cryptoasset”:

“A cryptoasset is a digital asset that operates within a peer-to-peer

network governed by a consensus mechanism which is controlled

by a public key infrastructure. The rules governing the system are

verified by network participants; these nodes can verify the entire

transaction history of the shared ledger.”

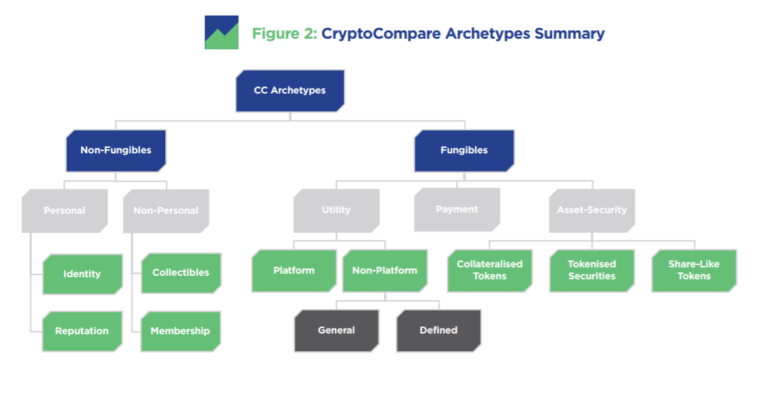

To come up with their new unique taxonomy (which they refer to in the report as “CryptoCompare Archetypes Summary” or “CryptoCompare Archetypes Grouping”), the CryptoCompare Research team took a “ground up” approach: the team “gathered data and performed analysis across a number of technological, economic and legal properties,” and this dataset helped to improve their understanding of the cryptoasset space “in a dynamic fashion.”

In total, the report looks at five ways to group cryptoassets: “the first four are driven by ‘real world’ questions” such as “What is a given cryptoasset used for? or “Is the token effectively controlled by a central counterparty?”. And the last grouping (“CryptoCompare Archetypes”) presents the research team’s own unique classification based on the main archetypes they identified during the study. This taxonomy “seeks to capture, in a simple form, the most meaningful grouping of cryptoassets,”, and furthermore, it aims “to understand the current state of the cryptoasset ecosystem.”

Fungible vs. Non-Fungible Tokens

- “Fungible tokens are perfectly interchangeable with other identical tokens. Traceability issues aside, one unit of Bitcoin is literally as good and as useful as any other.”

- “Non-fungible tokens – or NFTs – are tokens that are unique and hence not interchangeable with any other token… CryptoKitties represent one special case of a collectible NFT. NFTs may also be particularly useful in the case of digital assets that represent either the identity or the reputation of specific individuals going forward.”

- “Fungible tokens represent the vast majority of the tokens that exist,” although “the number and variety of NFTs is likely to grow substantially in the near future.”

Utility Tokens

- “Utility tokens are designed to offer digital access to an application or to some service using the blockchain.”

- “It remains unclear how utility tokens as defined here will be treated by the SEC.”

- “The majority of utility tokens in this taxonomy have undergone an ICO…”

- “Utility tokens vary significantly in their degree of centralisation and the extent to which they grant rights toward a particular counterparty.”

- “The first archetype under the utility section in the CryptoCompare archetypes is the ‘platform-based’ utility token. These are tokens that are used to gain access to general purpose decentralised networks for a wide range of possible applications. As such, these platform utility tokens exhibit considerably less centrality.”

- “Currently, Ethereum is the best example of the platform-based utility token.” Other examples include Cardano (ADA), EOS, and NEO.

- The second archetype under the utility section is the “non-platform-based” utility token. “Non-platform-based utility tokens… are generally understood as either ‘general’ or ‘defined’.”

- “Non-platform-based general utility tokens are open networks (hence the ‘general’ requirement) designed for a specific application or use case. Decentralised exchange tokens are a prime example.” One example of a top 20 cryptoasset in this category is NEM (XEM).

- “Defined non-platform-based utility tokens are more similar to what one might term a consumer token as the primary use is to provide access to a particular set of goods or a service…The tokens here are used on the network of a single project. However, this can clearly change and become more ‘general’ with time.” Two examples of top 20 cryptoassets in this group include the Binance Coin (BNB), TRON (TRX), and VeChain (VET).

- “Compared to platform-based tokens, these defined non-platform tokens are at once more centralised, more numerous, more likely to have undergone an ICO and are more likely to be dependent children of other native blockchains (in particular Ethereum, but also BTC, NEO, EOS etc).”

Payment Tokens

- “Payment tokens are designed to be used as a general purpose (across all networks) means of exchange or store of value.”

- “While the claims on the issuer of utility tokens remains somewhat uncertain, payment tokens typically give rise to no claims on the issuer. They are more decentralised than utility or asset-security tokens, boast larger market capitalisation, are almost always permissionless, are less likely to have ICO and have less concentrated ownership.”

Asset Tokens

- “Asset tokens represent assets which confer a financial claim (e.g. debt or equity claim) on an issuer or assets that grant explicit governance rights to token holders.” (“These include tokens that enable trading of both physical and non-physical assets on the blockchain.”)

- “derive their value principally from the economic value of the underlying asset (or cash flow) as opposed to the growth of the network (like, say, payment tokens).”

- The three types of asset tokens are “Collateralised Tokens”, “Tokenised Securities”, and “Share-Like Tokens”.

- Collateralised tokens may be collateralised by fiat (such as TrueUSD) or non-fiat assets (e.g. Digix, which is backed by gold).

- “… tokenised securities… allow bonds, stocks, equities and commodities to be traded as digital tokens. To this extent, this archetype does not represent a new asset class (i.e. cryptoassets) per se but instead constitutes an upgraded wrapper for the equity, bond, commodity asset class.”

- Share-like tokens “offer the rights to specific cash-flows (e.g. from centralised exchanges).”