On Tuesday (23 October 2018), crypto exchange Coinbase announced on its Medium blog that “Coinbase Custody had obtained a license under New York State Banking Law to operate as an independent Qualified Custodian,” and that “Coinbase Custody will operate as a Limited Purpose Trust Company chartered by the New York Department of Financial Services (NYDFS).”

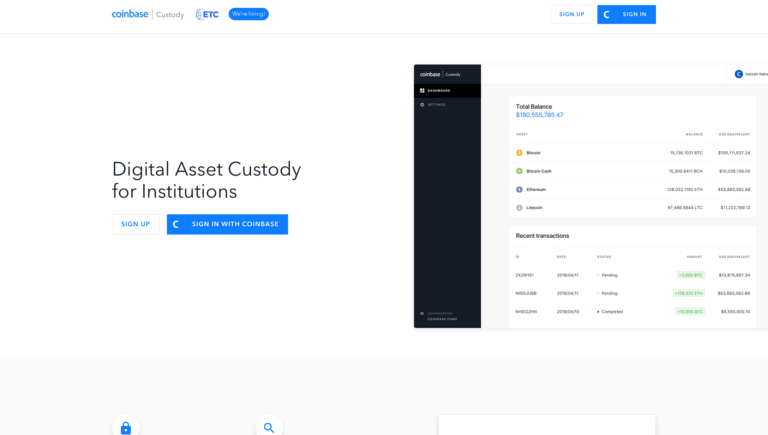

Coinbase Custody provides “an institutional-grade service optimized for storing large amounts of cryptocurrency in a highly secure way.” It has the following features:

- Segregated Cold Storage: “Separate and dedicated accounts for all your assets.”

- Financial & Security Controls: “… regular financial and security audits by external firms.”

- Dedicated Coverage: “Client service from Coinbase’s Institutional Coverage team in New York and ETC in LA.”

- SLAs on Fund Transfers: “Guaranteed response times to move assets.”

- Insurance: “Digital assets stored with Coinbase Custody are covered by our insurance policy.”

- Multi-User Accounts (Coming Soon): “Custom user and organizational controls across all your accounts.”

- Support for five digital asset types: Bitcoin, Bitcoin Cash, Ether, Ether Classic, and Litecoin. (Support for ERC-20 tokens coming soon.)

Coinbase says that “Coinbase Custody Trust Company will “operate as a standalone, independently-capitalized business to Coinbase Inc. and will be held to the same compliance, security and capital requirements as traditional fiduciary custodial businesses like the DTC.” This means that the company “has met the rigorous banking standards of NYDFS regarding capitalization, anti-money laundering procedures, confidentiality, security and storage. The trust charter also designates Coinbase Custody as a fiduciary under New York State Banking Law.”

As for the NYDFS, it issued a press release today, which said that

- The NYDFS had “approved the application of Coinbase Custody Trust Company LLC, a wholly-owned subsidiary of Coinbase Global, Inc., to operate as a limited purpose trust company.”

- “Coinbase Inc. has held Money Transmitter and Virtual Currency licenses from DFS since January 2017.”

- The NYDFS had approved “Coinbase [Custody] Trust to offer secure custody services for six of the largest virtual currencies: Bitcoin, Bitcoin Cash, Ethereum, Ether Classic, XRP and Litecoin.”

Financial Services Superintendent Maria T. Vullo stated:

“New York continues to be a leader in creating, fostering, and responsibly regulating a financial services marketplace that promotes innovation, safeguards the industry and protects consumers through strong supervision. Today’s approval further demonstrates that the state regulatory system is the best arena in which to responsibly supervise the growing fintech industry within a sound and compliant framework.”

And Asiff Hirji, President and Chief Operating Officer of Coinbase, added:

“Since 2014, the New York Department of Financial Services has proven itself to be a strong advocate in its support for the responsible growth of the cryptocurrency industry. The New York State Limited Purpose Trust charter, which now enables Coinbase Custody to act as a Qualified Custodian for crypto assets, builds on our unparalleled success as a crypto custodian while holding the company to the same exacting fiduciary standards and oversight of other, mature financial institutions operating in New York. We applaud the leadership Superintendent Vullo has shown to guide the responsible growth of the cryptocurrency ecosystem and look forward to working with their offices in the future.”

The Coinbase COO also sent out this tweet:

Another key step in the maturation of the asset class. Coinbase Custody now Qualified Custodian and fiduciary through NY State Trust Charter. Same rigorous standards as some of the largest financial institutions in the country https://t.co/Eg7zauTeku

— Asiff Hirji (@AsiffHirji) October 23, 2018

Anthony Pompliano, Founder & Partner at Morgan Creek Digital, had this to say:

Coinbase is now a Qualified Custodian. This is the second custody provider to achieve QC status.

The excuses for institutions to continue avoiding this asset class are disappearing.

They must #GetOffZero.

— Pomp 🌪 (@APompliano) October 23, 2018

There are three interesting things to note about this announcement:

- Coinbase Custody, which had until now been a division of Coinbase, Inc., is now a new legal entity that is separate and “independently-capitalized” from Coinbase, Inc., which means a greater level of protection for the clients of Coinbase Custody.

- Coinbase has now become the only U.S.-based crypto exchange that offers its own qualified custody service for cryptoassets. (But note that crypto custody solution providers Kingdom Trust and BitGo are also qualified custodians for digital assets, having received their trust charters from South Dakota Division of Banking.)

- The New York State Department of Financial Services approved Coinbase Custody Trust to offer custody for XRP, even though Coinbase Custody currently does not offer support for XRP, which means that it is highly likely that Coinbase Custody is planning to offer support for XRP in the near/medium future (otherwise, why would Coinbase Custody Trust ask the NYDFS to give its blessing for custody of XRP tokens?).

Featured Image Courtesy of Coinbase