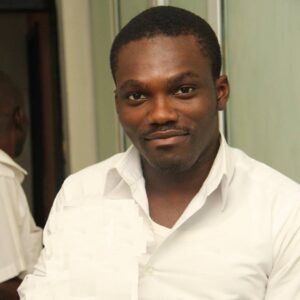

President Rob Jesudason has criticized existing KYC and AML measures for failing to prevent crime and placing an unnecessary burdens on users. Jesudason’s maverick position was expressed in a Medium article.

Problems with Current Paradigm

Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations stipulate that financial services institutions collect identity documents from users. The aim is to curb crime by identifying and stopping non-conforming actors.

Jesudason believes the manner in which these methods are executed have not been effective in curbing crime citing the case of Denmark’s Danske Bank, which was discovered to have laundered 200 million euros. It is obvious employees conspired in the money laundering and tampered with records despite existing KYC/AML regulations.

Advocates of decentralization consider KYC/AML a problem as identity checks are capable of denying a section of society access to essential services such as banks and other financial services. In contrast with the mission of crypto advocates of providing an economic system easily accessible to everyone, most crypto exchanges now need KYC/AML identity checks and their numbers are on the rise.

Blockchain Integration

Despite his observations and uncommon position, Jesudason is not of the opinion that KYC/AML regulations should be abandoned. To ensure record and document integrity, he suggests an integration of blockchain technology into KYC/AML practices thus enabling users to have a universal identity across platforms.

EOS’s role in identity management remains vague despite Jesudason’s support for a new system as it does not have an official identity management platform at present. Competition is stiff with Civic and Ontology maintaining dominance in the Blockchain-based identity management space and Microsoft recently joining. EOS is unlikely to become directly involved with identity management.