On Sunday (7 October 2018), crypto exchange Bitfinex struck back at allegations of insolvency that have been recently floating around on Twitter, Reddit, and Medium.

Although unsubstantiated rumors suggesting that Bitfinex is insolvent are nothing new (perhaps, starting as early as August 2016, when the exchange got hacked and nearly 12,000 bitcoins worth about $72 million were stolen), a week ago, these rumors got a massive boost when stories started surfacing about Peurto Rico-based Noble Bank International (which some people think is/was Bitfinex’s primary bank) being on the brink of insolvency and trying to find a buyer. For example, as covered by CryptoGlobe, this is what Bloomberg reported on 1 October 2018:

“Noble Bank International, the Puerto Rican financial services firm with clients that have included prominent cryptocurrency ventures, is looking for a buyer, according to a person with direct knowledge of the situation… The bank has lost many of its customers, including Bitfinex and Tether, and is no longer profitable, the person said… Noble Bank attracted attention in cryptocurrency circles earlier this year because of its willingness to work with Tether and Bitfinex, which was dumped last year by Wells Fargo & Co.”

This news was quite alarming to some members of the crypto community because if Noble Bank was really insolvent, it could suggest that were problems also with Bitfinex and/or Tether. Reports on Bitfinex's official subreddit from some users claiming to have difficulty receiving fiat withdrawals from Bitfinex did not help matters.

All of this led to some reports on Medium alleging that Bitfinex was insolvent. The best example of this (and probably the one that upset Bitfinex the most) is by Medium user “ProofOfResearch”, who wrote on 6 October 2018 that his investigation of complaints about Bitfinex on social media had led him to believe that “Bitfinex is No Longer Solvent ” and that Bitfinex users should remove their funds from the exchange immediately.

Bitfinex’s rebuttal to these recent online rumors was published on 7 October 2018 on Bitfinex’s Medium blog. The blog post started by saying that although there had been “ups and downs along the way” since Bitfinex introduced fiat operations in 2015, those “investigators” who have been scrutinizing every “complication” and “quick to scream insolvency” seem to have “little understanding of what this concept means and what they are generally talking about.”

Here is how Bitfinex chose to address some of the allegations against it:

- “Bitfinex is not insolvent, and a constant stream of Medium articles claiming otherwise is not going to change this. As one of only a very few exchanges operating since 2013, with a small team and low operating costs, we do not entirely understand the arguments that purport to show us to be insolvent without providing any explanation about why.”

- “Both fiat and cryptocurrency withdrawals are functioning as normal. Verified Bitfinex users can freely withdraw Euros, Japanese Yen, Pounds Sterling and U.S. Dollars. Complications continue to exist for us in the domain of fiat transactions, as they do for most cryptocurrency-related organisations. However, we continue to do our utmost to minimise any waiting times associated with fiat deposits and withdrawals.”

- “Stories and allegations currently circulating mentioning an entity called Noble Bank have no impact on our operations, survivability, or solvency.”

As a way of showing solvency, BItfinex provides links to three cold wallets: a BTC wallet, an ETH wallet, and an EOS wallet. The largest one is the BTC wallet, the contents of which are shown below (thanks to BitInfoCharts):

As you can see, this wallet seems to have approximately 148,467 bitcoins worth around $979 million. Furthermore, Bitfinex points out that these three wallets only “represent a small fraction of Bitfinex cryptocurrency holdings and do not take into account fiat holdings of any kind.”

Although Bitfinex critics will probably only be satisfied by Bitfinex allowing all of its bank accounts (and its cryptocurrency wallets) to be independently audited, what Bitfinex is offering as proof does not go that far, and will highly likely not be able to stop all of the insolvency rumors.

At the same time, what Bitfinex’s harshest critics, such as “ProofOfResearch”, are offering as evidence of insolvency cannot be considered as definitive proof. For example, in his reply to Bitfinex's rebuttal, “ProofOfReserch” says that Bitfinex has chosen to “simply ignore dozens of customers that are worried about not receiving their wire transfers” (based on now deleted Reddit posts from alleged Bitfinex customers). How do we know that such posts are from real Bitfinex customers? However, even if there were “dozens” of real complaints on Reddit about fiat withdrawals, that still does not prove “insolvency” even though it might suggest problems with customer service.

Over on Twitter, crypto analyst Larry Cermak (who was until recently Head of Analysis at Diar), said that Bitfinex’s new bank was HSBC:

Bitfinex is now banking with HSBC through a private account of Global Trading Solutions. Very good fit if you ask me. It's also worth mentioning that all EUR, JPY and GBP deposits are paused but Bitfinex “expects the situation to normalize within a week”. Banking issues? pic.twitter.com/1pxQ13NO0m

— Larry Cermak (@lawmaster) October 6, 2018

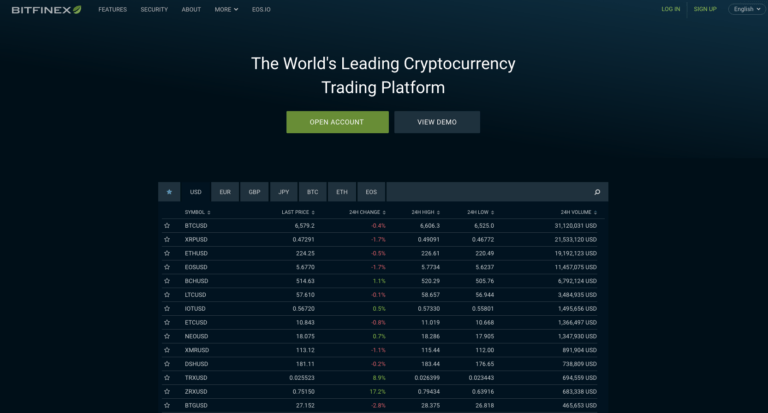

Featured Image Courtesy of Bitfinex