Bitfinex exchange today announced an upgrade to its fiat currency deposit system, after causing a stir last week by briefly halting U.S. dollar, GBP, EUR and Japanese Yen deposits.

The company’s “new, improved and increasingly resilient […] system” was detailed in an official blog post:

- A user wishing to initiate a fiat deposit on Bitfinex will create a deposit request to signal interest in completing a deposit. Through this deposit request, a user will be able to specify the exact amount and currency which they wish to deposit.

- Following an account review (which may take up to 48 hours), the user will receive a deposit notification which will include, among other things, bank details specific to the individual’s transaction.

- The user will be able to initiate the deposit based on the information received through the deposit notification. The deposit will subsequently be processed within 6-10 business days from Bitfinex.

Based on the released information, it seems that Bitfinex users can expect to change the destination of their minimum $10,000 deposits on a fairly regular basis.

At press time, social media is already abuzz in an attempt to come to grips with Bitfinex’s new “system” — although some are hard pressed to spot the difference from the old system, some are questioning the increased KYC requirements.

Someone will ask, so it mind as well be me I guess. How are these new accounts different from the old accounts?

— Richard Heart (@RichardHeartWin) October 16, 2018

Looks like @bitfinex fiat deposits are open… But it requires more KYC docs 🙂 pic.twitter.com/yvAYwExfMR

— WhalePanda (@WhalePanda) October 16, 2018

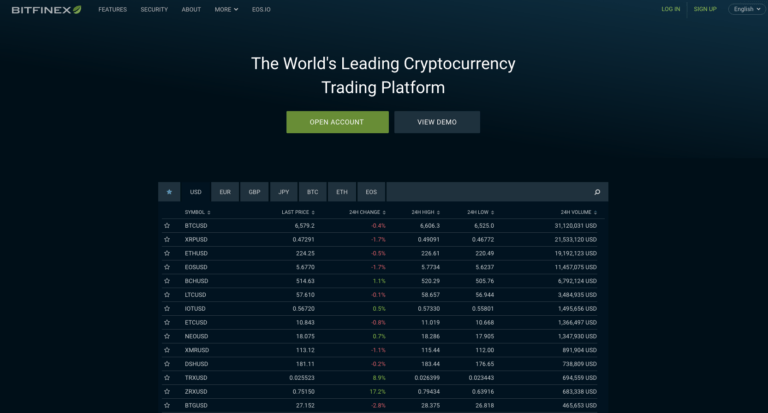

The chart below shows that the announcement has already caused a modest drop in the bitcoin price premium on Bitfinex’s exchange, which should be taken as a sign of renewed market stability. A “premium” is when an asset (e.g., bitcoin) is trading at a higher price on one exchange versus another.

As CryptoGlobe reported yesterday, exchanges trading bitcoin against the Tether (USDT) stablecoin saw dramatic price premiums versus exchanges trading bitcoin against genuine U.S. dollars.

Tether is closely affiliated with Bitfinex, the British Virgin Islands-registered companies share a significant proportion of their investors and management. They were both subpoenaed by the U.S. Commodity Futures Trading Commission earlier this year.

Yesterday’s price pumps appears to have begun when Kucoin exchange briefly halted Tether deposits and withdrawals, possibly sparking renewed fears regarding Tether’s solvency. Kucoin’s actions were followed by the fake news that the Binance cryptoasset exchange would delist Tether. CryptoGlobe has compiled a graphical timeline to illustrate yesterday’s events.

As CryptoGlobe reported last week, Bitfinex’s deposit outage coincided with a raft of speculation regarding the company’s financial solvency, after repeatedly procuring and dissolving banking relationships with various banks throughout the year.

Continuing the ongoing saga, Bitfinex was recently reported to have secured new banking relationships with London-based banking giant HSBC, although neither Bitfinex nor HSBC will confirm any such connection.

A Parthian Shot

In concluding today’s upgrade announcement, Bitfinex issued a missive saying they believe:

this system to be significantly more durable in the face of sustained attacks by our competition and their supporters

Such statements resonate with an official blog post put out a week ago by the company, which again addressed its detractors claiming insolvency, saying such criticism was a “targeted campaign”. Bitfinex downplayed rumors of insolvency and seemed to shed any connection with “an entity called Noble Bank”.

CryptoGlobe and many other news outlets recently reported that Puerto Rico-based Noble Bank had had banking relations with Bitfinex and Tether, and that those relations were recently terminated.

“Complications continue to exist for us in the domain of fiat transactions, as they do for most cryptocurrency-related organisations”, the company conceded.