Privacy-focussed cryptocurrency Monero (XMR) has recorded some particularly impressive gains in the last two weeks as the altcoin market has showed some signs of a steady recovery since mid-August.

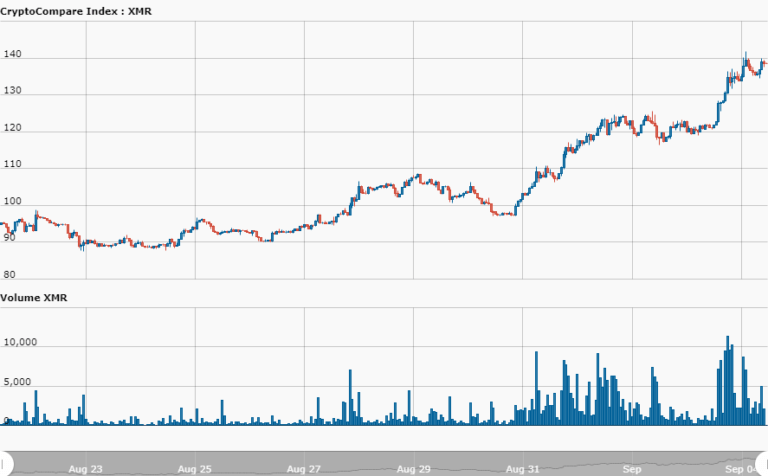

Monero is up over 45% in the last two weeks – with a particular spike in volume in the last 24 hours to reach a price of $138 at the time of writing (4th September 10.35 UTC).

Source: MVIS CryptoCompare Index

Source: MVIS CryptoCompare Index

The figure is particularly impressive if we compare the privacy coin’s gains to other top altcoins: the MVIS CryptoCompare Digital Assets 25 Index, a modified market cap-weighted index which tracks the performance of the 25 largest and most liquid crypto-assets, shows a gain of a little over 17% for the same period across the assets.

Comparing XMR to its privacy rival, ZCash, also demonstrates the strength of XMR’s gains – with ZCash also seeing a surge in price since Aug 21s – posting gains just shy of 21%.

Why is XMR Pumping?

Notwithstanding the fact that any clear-cut explanations for jumps in cryptocurrency prices are nearly impossible to isolate – it is possible that research published last week by ICO advisory firm Satis Group for Bloomberg, has contributed to the bullishness surrounding XMR.

Using what they describe as a “Top Down” approach to valuation (“using the quantity theory of money to deduce the value of crypto-assets needed to support a forecasted economy”) – the research group’s forecasts for Monero are the biggest by some way – with estimated one-year gains over 1336%, and a 10-year forecast of XMR hitting nearly $40,000 – a projected gain of over 38,000%.