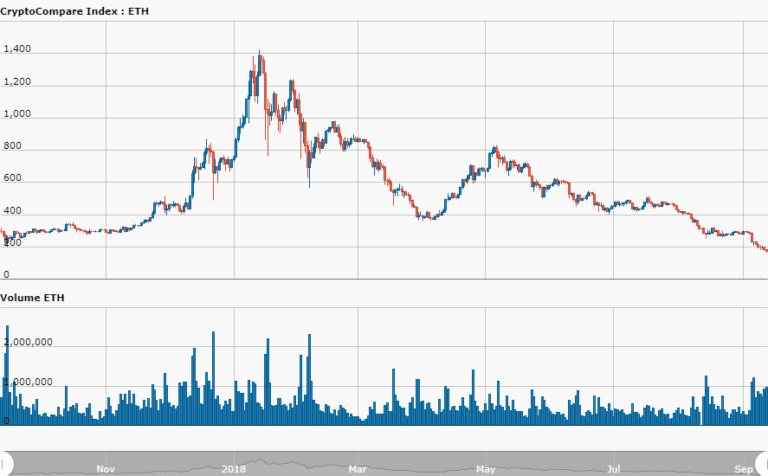

The price of the second largest cryptocurrency by market cap has maintained its leading position in the crytocurrency market’s down hill race – shedding over 80% of its value to the lowest it has been since may last year.

The sharp decline in Ether’s value comes at a time when news regarding the cryptocurrency sector is predominantly negative – with the latest news being the possible opening of a gap for costly and distracting litigation to sweep through the sector, after Tuesday’s ruling from a US judge stating that US securities laws are applicable to cryptocurrencies.

Ether’s continued sell-off has sparked the interests of traders looking to bet on the cryptocurrency’s possible demise (shorting the market is done through funds borrowed from an exchange’s leading market). According to Hong-Kong based cryptocurrency exchange, Bitfinex, outstanding short interest in Ether ballooned to a record 240,000 ETH.

As the network struggles with scalability (being the first choice blockchain for cryto-related ventures), the price of Ether has dropped about 74% since the beginning of 2018 and has shed approximately 90% of its value since its all time high. This downward trend prompted David Drake, chairman of LDJ Capital, to comment – telling Marketwatch.com:

Ether is like the Middle Ages of technology at the moment. There are protocols like Stellar that have proven to be faster and more efficient and until ethereum can sort out its network it will struggle.

As Ether seems to face continued selling pressure, David Drake is not the only one to have weighed in.

CryptoCompare founder and CEO, Charles Hayter, also voiced his opinion on the drop – telling BusinessInsider:

It's a continuation of the story that ICOs are selling their raised funds, which are adding to downward pressure. This has spooked the market and turned the dial up on the negative sentiment..