On Monday (10 September 2018), digital asset exchange Gemini, which was founded in 2014 by Cameron and Tyler Winklevoss, announced that it had launched the “Gemini Dollar” (GUSD), a dollar-backed stablecoin built on .

The Gemini website says:

- The Gemini dollar is the world’s first regulated (by the New York State Department of Financial Services) stablecoin (combining “the creditworthiness and price stability of the U.S. dollar with blockchain technology and the oversight of U.S. regulators”).

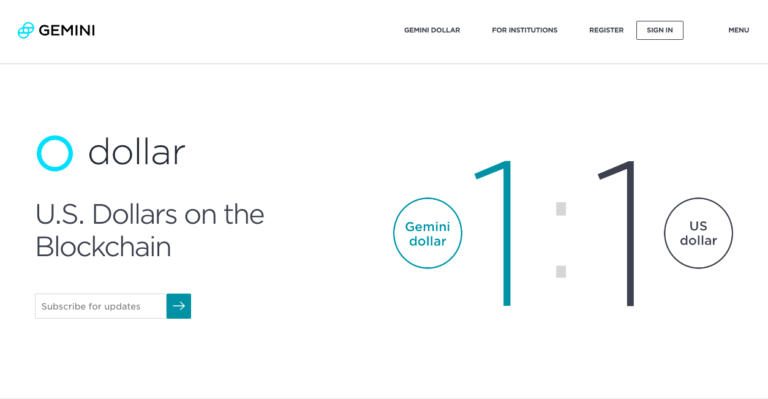

- You can get Gemini dollars 1-to-1 for U.S. dollars on the Gemini exchange.

- Gemini dollars can be used on the Ethereum network.

- The issuer is Gemini Trust Company (a New York trust company).

- U.S. dollars corresponding to the Gemini dollars in circulation are held at a U.S. bank, and are eligible for FDIC “pass-through” deposit insurance (federal deposit insurance coverage that applies to the interests of owners or beneficiaries in a qualified fiduciary or custodial account).

- “The U.S. dollar deposit balance is examined monthly by an independent registered public accounting firm to verify the 1:1 peg.”

- “The Gemini dollar is a cryptographic token built on the Ethereum Network according to the ERC20 standard for tokens.”

The following two diagrams was used to illustrate how the process of getting Gemini dollars and U.S. dollars works:

In a post on the Gemini blog, Cameron Winklevoss described the motivation for the Gemini dollar:

While cryptocurrencies operate 24/7/365 (similar to email), fiat currencies only operate during specific “business hours” (like snail mail) — a fundamental mismatch. As a next step in our mission, we must improve the linkage between these worlds by giving fiat currency the same desirable technological qualities of cryptocurrencies.

According to a report in MarketWatch, the U.S. dollars will be held by State Street Bank, and the deposit balance will be audited monthly by BPM, one of the largest California-based accounting and consulting firms in the U.S., to to ensure that there is a U.S. dollar for every Gemini dollar in circulation.

Anthony Pomplianao, Founder & Partner at Morgan Creek Digital, had this to say about the Gemini dollar:

Winklevoss twins just announced a stablecoin backed by USD. The Ethereum-based token is:

– Approved by NY Department of Financial Services

– Dollars held in FDIC-insured State Street account

– Audited by multiple third-parties at various timesThe market continues to mature.

— Pomp 🌪 (@APompliano) September 10, 2018

Interestingly, today, another regulated stablecoin got announced. Blockchain startup Paxos launched Paxos Standard (PAX). Like the GUSD token, the PAX token is built on the Ethereum blockchain, is fully collateralized 1:1 by the U.S. dollar, issued by the Paxos Trust Company, and approved and regulated by the New York State Department of Financial Services.

These two new stabecoins will be competing with existing stablecoins such as Tether (USDT), TrueUSD (TUSD), and Dai (DAI). Currently, Tether is the most traded stablecoin, but it is controversial for two reasons: there is a concern in the crypto community that it is not fully backed by U.S. dollars (a concern that does not want to go away since Tether refuses to disclose the names of the banks holding its U.S. dollars); and there is also the concern in the community that Tether is allegedly being used for market manipulation.

Featured Image Courtesy of Gemini Trust Company