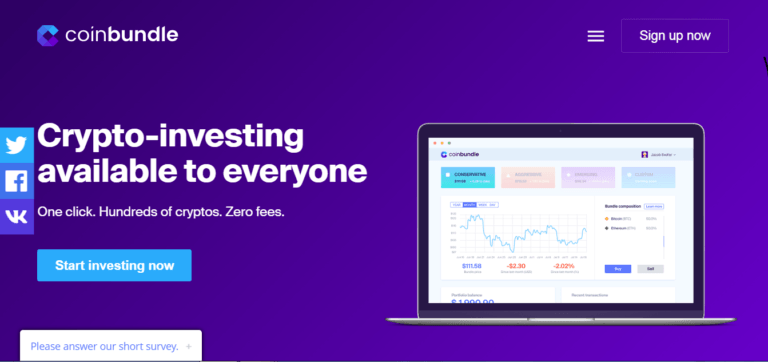

CoinBundle, a cryptocurrency investment platform, was officially launched on September 20th after first being introduced on Product Hunt, a website that lets users share and test new products. CoinBundle allows users to purchase “bundles” of digital currencies instead of buying individual tokens.

Saad Rizvi, the co-founder and CEO of CoinBundle, told CryptoGround (on September 10) that his firm is “bringing a tried and tested methodology from traditional finance and stock investing to cryptocurrencies.”

Historically Better Performance

Rizvi explained that investments in “bundled” stocks such as exchange-traded funds (ETFs) and mutual funds generally perform better in the long-term compared to investments in single, or individual, stocks.

As mentioned in CoinBundle’s press release, users may invest in “curated bundles based on their risk profiles.” All cryptocurrency investments will also be “stored with a qualified custodian.” Additionally, users’ funds will reportedly be “insured against theft” by the Lloyd’s of London, a corporation that serves as an insurance and reinsurance market.

Founded in early 2018, CoinBundle has reportedly received investments venture capital firm Amino Capital, Y Combinator, Initialized Capital, Funders Club, and Switch VC. The San Francisco-based startup has also been funded by legendary National Football League (NFL) quarterback Joe Montana’s VC firm Liquid2.

Crypto ETF, Conservative, Aggressive Investments

CoinBundle’s long-term goals include “enabling the next billion users from emerging markets to take full advantage of investing in cryptocurrencies.” The crypto investment platform’s developers also aim to help users “participate in the New Internet (Web 3.0)” – a new paradigm in web-based technology developed using artificial intelligence.

Significantly, one of CoinBundle’s most sought after services might be its “open ecosystem for crypto ETFs” which is reportedly in its early stages of development. Currently, users are able to invest in the company’s three different crypto bundles which include: Conservative (CNS2), Aggressive (AGR10), Emerging (EME10). A Thematic bundle will be added later on as it’s completing its “final stages of development.”

As described on CoinBundle’s official website, the CNS2 bundle consists of bitcoin (BTC) and ethereum (ETH) investments. The Aggressive, or AGR10 bundle, includes ripple (XRP), bitcoin cash (BCH), litecoin (LTC), bitcoin, among others.

Halal, Eco-Friendly Bundles

The Emerging bundle includes crypto assets which CoinBundle has identified as “high potential emerging technologies” such as ZCash (ZEC). As covered, the Digital Asset Research group believes ZCash offers better privacy features than Monero (XMR).

CoinBundle’s Thematic bundle offers users the option of investing in cryptocurrencies that “align with [their] values” like an environmentally-friendly bundle or the Halal bundle for Muslim investors.

According to the digital asset investment firm’s press release, their crypto bundles have been put together after “extensive qualitative and quantitative research” performed by an “in-house finance team.”