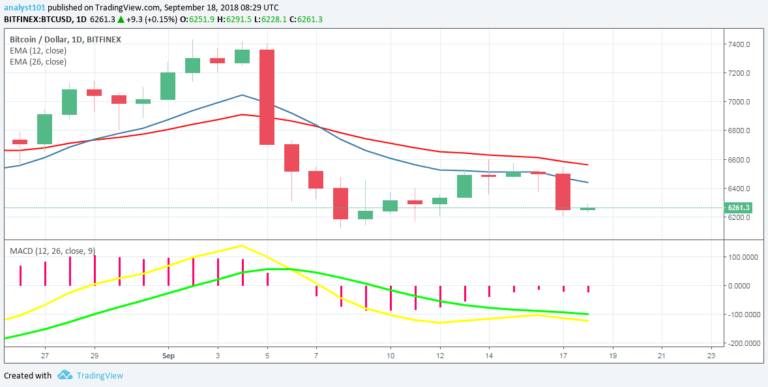

BTCUSD Medium-term Trend: Bearish

Resistance levels: $6,500, $6,700, $6,900

Support levels: $6,300, $6,100, $5,900

The BTCUSD pair was in a bearish trend yesterday. Before the bearish trend, the price of Bitcoin had been range bound between the levels of $6,400 and $6,200 in the last ten days. It was at this range bound zone that the price pulled back to the lower level.Today, the cryptocurrency is fluctuating above the lower level of the price range at $6,200.

If the price breaks this level, there are indications that it will find its low at the $6,075 and $5,900 support zone. If the bulls defend this zone and the price bounces back, traders should initiate long trades and stop-loss orders below the $5,900 price level. You can exit your long trades at the resistance of $6,400 or when the price reverses.

On the other hand, if the lower level of $6,200 price level holds, the BTC price will attempt to reach the high of the $6,400 price level. However, the MACD line and the signal line are below the zero line which indicates a sell signal. The price of Bitcoin is below the 12-day EMA and 26-day EMA which indicates that the price is falling.

BTCUSD Short-term Trend: Ranging

On the 4-hour chart, the BTC price is in a bearish trend. The BTC price fell to the low of $6,260.10 and commenced a range bound movement. Meanwhile, the Relative Strength Index period 14 is level 35 which indicates that the market is oversold suggesting bulls will take control of the market.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.