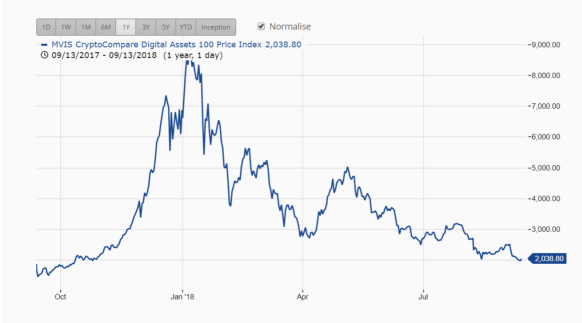

In stark contrast to most of 2017, cryptocurrency prices have been plummeting since reaching an all-time high in January.

The altcoin market in particular, has seen an 85% drop since the previous peak – as can be seen from the MVIS CryptoCompare 100 Index in the title graph. As pointed out by some members of the crypto community on Twitter, this year’s altcoin decline is close to becoming the worst ever in the history of cryptocurrency:

Biggest decline in altcoin marketcap was in 2014 -86% with a total duration of 266 days before a massive bounce.

Today we are sitting at a decline of -85% in 252 days. #2weeks pic.twitter.com/TD6bs1lM1c

— Galaxy (@galaxybtc) September 11, 2018

In 252 days, the altcoin market cap has dropped 85%. The worst altcoin bear market, that of 2014, lasted 266 days and wiped out 86% of value before a reversal in trend took place.

This year, crypto enthusiasts and analysts alike are making comparisons with the 2014 bear market and hoping that the current bearish trend will end as the bear market nears the 266-day mark.

Others are of the view that most altcoins with no use-case would have to drop to 0 and be abandoned before there can be a turnaround from bearish to bullish signals in the altcoin and crypto market in general. Until then, the nose-dive of altcoin prices is expected to continue.

Twitter user @YORK780 tweeted:

On: we shouldn’t ignore that there are more than 1934 altcoins rightnow, and that their dominance is way higher than in 2014. Altcoins are more volatile than Bitcoin, so we will perhaps go below the 86%.

— YORK780 (@YORK780) September 12, 2018

Worse Than the Dot-Com Crash

Earlier today, Bloomberg News also reported that the decline in crypto prices since January is worse than the historic 2001 dot-com crash. The 80% drop in crypto prices surpasses the 78% decline recorded by the NASDAQ composite index from the heights of its last peak to the price at which it bottomed out in 2002.

The altcoin market which has seen more volatility is the hardest-hit. For instance, Ethereum, the largest and most popular altcoin was priced at $170, a sixteen month low, at the time of writing. This represents a 74% decline since January and a 90% loss of value since the last all-time high.

The continuous decline in prices led by the altcoins has led experts like Neil Wilson, a Markets.com chief market analyst to conclude that Bitcoin could come out as the only surviving cryptocurrency in the end.

It’s a very likely a winner takes all market — Bitcoin currently most likely.

As with the NASDAQ composite index, the crypto market is expected to bounce back eventually with a more positive effect on society. Many seasoned crypto investors who have experienced multiple bear markets have similar expectations but expect most “scams” and not-so-useful projects in the ecosystems to first die out.