Ethereum Price Medium-term Trend: Ranging

Supply zones: $400, $450, $500

Demand zones: $200, $150, $100

ETH in the range in the medium-term outlook. The strong bearish pressure was sustained leading to the break of $346.62 at the lower demand range of price analyzed on the 10th of August. Increased bearish momentum pushed the cryptocurrency further down to $305.10 in the demand area.

The bears then lost momentum as a rejection of downward continuation was seen in the candles with wicks. The bullish engulfing candle was an indication that the bulls returned.

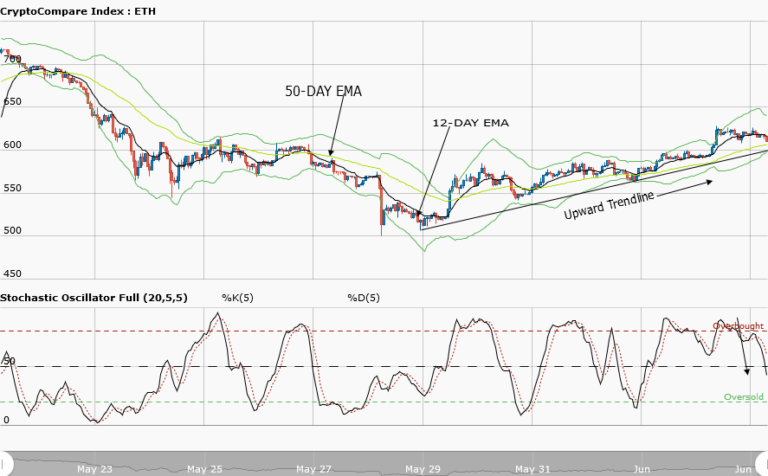

The stochastic oscillator is at 32% and its signal points up which signals upward movement for the cryptocurrency within the range. ETH is still ranging and trading between $354.88 in the upper supply area and at $308.57 in the lower demand area of its range. Traders should be patient and wait for a breakout at the upper range to go long or breakdown at the lower range for a short position.

Ethereum Price Short-term Trend: Ranging

ETH returns into consolidation in its short-term outlook. Bullish momentum pushed its price from $327.35 in the supply area to $315.89 in the demand area below the 10-day EMA. The formation of a bullish spinning top brought back the bulls whose pressure pushed the price back up the supply area at $327.93

The stochastic oscillator is at 22% and its signal is parallel which reflects the current ranging scenario. It is trading between $327.44 in the upper supply area and $315.88 in the lower demand area. Traders should be patient and wait for either a breakout or a breakdown to happen before taking a position.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.