Social media are ever more present in everyday life, reflecting and influencing behaviour. This is increasingly being recognized within the traditional financial sector, as evidence is mounting that Twitter sentiment can forecast asset prices. See for example Twitter as a tool for forecasting stock market movements: A short-window event study or Predictive Sentiment Analysis of Tweets: A Stock Market Application.

Looking to the future or past?

Within the crypto space, indicators are mainly technical, meaning that they are relying on past prices to predict future returns. Though sometimes effective, past prices do not capture changing market conditions. Prediction of asset prices means gathering information about the future, not about the past. A technical indicator cannot account for an impending change in regulation boosting the price, or a Pyramid scheme or scam dramatically causing the price to drop. This means that technical indicators (if they do seem to work for a short time) have only limited efficacy.

Exploring the future

With this in mind, we set out to see what sentiment analysis has to offer in relation to cryptocurrency prices.

More specifically, we started scraping and analysing Twitter data in order to gauge if this would prove to be a helpful indicator.

Without getting too technical, we gathered all Tweets about the 100+ largest cryptocurrencies over time (using so-called cashtags in order to minimize noise), using a Python-based code. Using this method, all the Tweets are scored using an algorithm that determines textual sentiment to see if they are positive or negative on a range from +1 to -1 (ie, a score of 1 means the Tweet is extremely positive).

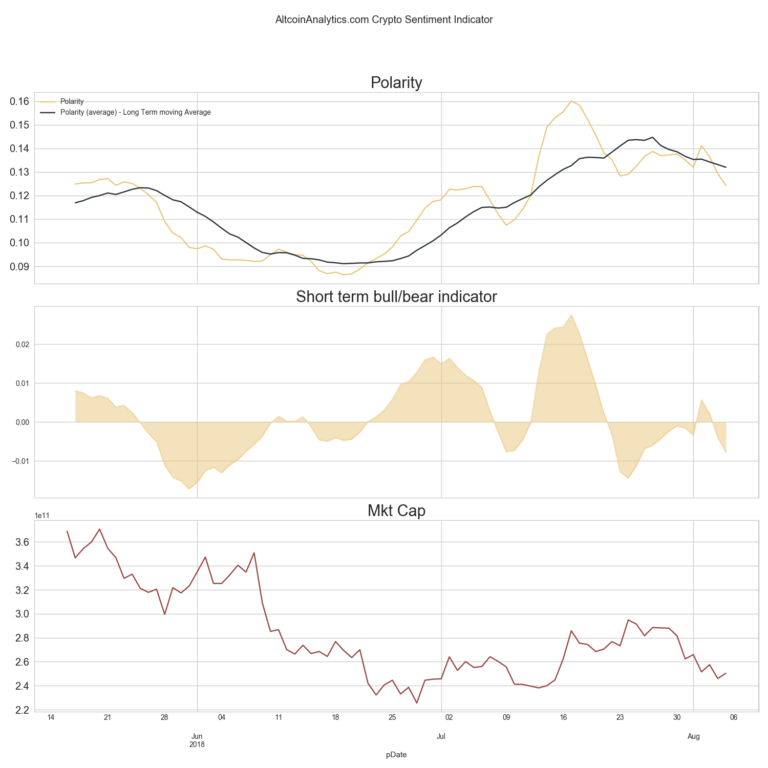

But before diving in to the technicals, first let’s have a look at the results. The plot in the title graph shows sentiment (polarity), a bull/bear indicator (which looks at short term sentiment compared to a longer term average) and the sum of market capitalisation of all cryptocurrencies analysed.

Interestingly it shows a decrease in sentiment prior to the market declining at the start of July. When markets started to pick up again sentiment was already recovering for a period. Though the sample is obviously too short to make any bold statements, there seems to be some value in using sentiment as an indicator.

That being said it cannot be stressed enough that all indicators are imperfect, and the future is always fuzzy. Moreover, this indicator should not used n isolation and adds value only by placing it in a broader context.

What about sentiment on an individual level?

Having seen the first results on aggregate level, it’s interesting to zoom in on a more individual level. As an example, take Stellar (XLM ). The chart below shows the market cap (top chart) versus several sentiment indicators (bottom 5 charts):