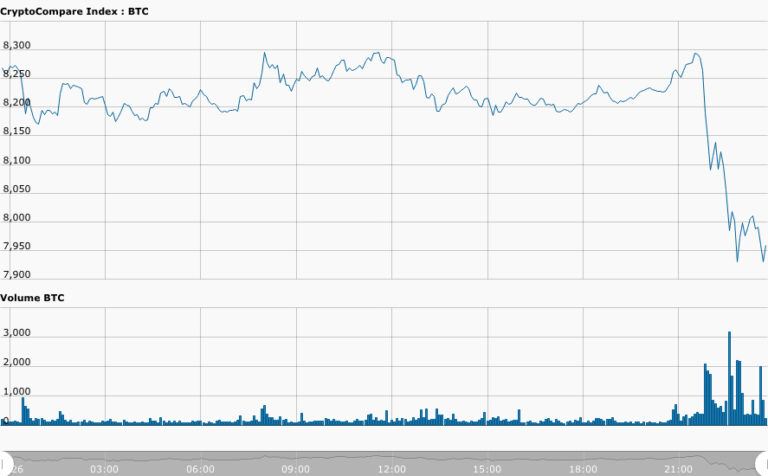

On Thursday (26 July 2018), the U.S. Securities and Exchange Commission, once again, disapproved a Bats BZX Exchange application to list the Winklevoss Bitcoin ETF, causing the bitcoin price to drop (at press time) by more than 3.5% to below $8,000. The SEC said that it was not convinced that the market would have adequate surveillance. It announced its decision via a filing.

Here’s a brief history:

- On 30 June 2016, Bats BZX Exchange filed a proposed rule change with the Commission, seeking to list and trade shares of the Winklevoss Bitcoin Trust.

- The SEC disapproved the proposed rule change on 10 March 2017.

- BZX then filed a petition (on 17 March 2017) seeking the SEC review of the disapproval.

- The SEC granted BZX’s petition for review, seeking public comments in support of or in opposition to the March Disapproval Order.

- Today’s order sets aside the March 10th Disapproval Order, and, disapproves (for the second time) BZX’s proposed rule change.

The SEC has conducted a de novo review of BZX’s proposal, “to determine whether the proposal is consistent with the requirements of the Exchange Act and the rules and regulations issued thereunder that are applicable to a national securities exchange.” More specifically, it has considered “whether the BZX proposal is consistent with Exchange Act Section 6(b)(5), which requires, in relevant part, that the rules of a national securities exchange be designed ‘to prevent fraudulent and manipulative acts and practices’ and ‘to protect investors and the public interest.'”

The burden “to demonstrate that a proposed rule change is consistent with the Exchange Act and the rules and regulations issued thereunder … is on the self-regulatory organization [SRO]… that proposed the rule change.” This means that “any failure of an SRO to provide this information may result in the Commission not having a sufficient basis to make an affirmative finding that a proposed rule change is consistent with the Exchange Act and the applicable rules and regulations.”

Here were BZX’s main arguments:

- Its proposal was consistent with Exchange Act Section 6(b)(5) on the grounds that the “geographically diverse and continuous nature of bitcoin trading makes it difficult and prohibitively costly to manipulate the price of bitcoin” and that, therefore, the Bitcoin market “generally is less susceptible to manipulation than the equity, fixed income, and commodity futures markets” and because “novel systems intrinsic to this new market provide unique additional protections that are unavailable in traditional commodity markets.”

- The March Disapproval Order “failed to appreciate that the proposal provides ‘traditional means of identifying and deterring fraud and manipulation’ and that the proposal met the criteria that the SEC has utilized in approving other commodity-trust Exchange Traded Product (ETPs).

- The March Disapproval Order overstates the extent to which surveillance and regulation of the underlying market have been present in prior commodity-trust ETP approval orders and the extent to which the SEC has relied on the existence of surveillance-sharing agreements between an ETP listing market and markets related to the underlying assets.

The SEC noted that although it is disapproving this proposed rule change, it wished to emphasize that “its disapproval does not rest on an evaluation of whether bitcoin, or blockchain technology more generally, has utility or value as an innovation or an investment.” There were more hopeful signs that the SEC was not ruling out the possibility of approving Bitcoin ETFs in the future:

“While the record before the Commission indicates that a substantial majority of bitcoin trading occurs on unregulated venues overseas that are relatively new and that, generally, appear to trade only digital assets, and while the record does not support a conclusion that bitcoin derivatives markets have attained significant size, the Commission notes that regulated bitcoin-related markets are in the early stages of their development. Over time, regulated bitcoin-related markets may continue to grow and develop. For example, existing or newly created bitcoin futures markets may achieve significant size, and an ETP listing exchange may be able to demonstrate in a proposed rule change that it will be able to address the risk of fraud and manipulation by sharing surveillance information with a regulated market of significant size related to bitcoin, as well as, where appropriate, with the spot markets underlying relevant bitcoin derivatives. Should these circumstances develop, or conditions otherwise change in a manner that affects the Exchange Act analysis, the Commission would then have the opportunity to consider whether a bitcoin ETP would be consistent with the requirements of the Exchange Act.”