Prominent San Francisco-based cryptocurrency exchange Coinbase is reportedly seeing its popularity drop due to the price decline most cryptocurrencies have been enduring. The company’s download rankings have fallen to their lowest among US finance apps since April 2017.

According to Quartz, Coinbase’s app was the top finance app in the US back in December – when most cryptocurrencies hit their all-time highs. Bitcoin, the flagship cryptocurrency, came close to $20,000 at the time, but has since declined to about $6,300 at press time, according to CryptoCompare data.

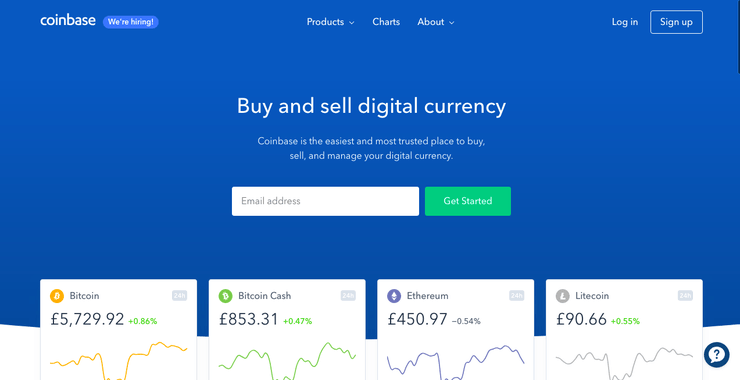

Coinbase, which recently added support for GBP deposits and withdrawals, saw its app fall to 40th place in the June download rankings, seemingly affected by the market’s bearish trend. As Quartz points out, users may still access it via its website, which according to SimilarWeb also saw traffic plunge.

Per the website’s statistics, Coinbase’s traffic plunged from 126 million monthly visits in January, to about 28 million in June.

The company has been building services that may affect its overall traffic in the past few months. After saying goodbye to its Global Digital Asset Exchange (GDAX) and rebranding it into Coinbase Pro, which launched to little fanfare, the San Francisco-based startup launched the Coinbase Index Fund, which gives US accredited investors exposure to digital assets listed on Coinbase Pro.

Coinbase is reportedly valued at $8 billion, making it one of the most valuable companies in the cryptosphere behind Bitmain, which was valued at $12 billion in a funding round. It makes money by charging transaction fees and made over $1 billion in revenue last year, Quartz repots.

The decline hasn’t exclusively been affecting Coinbase, however, as most cryptocurrency exchanges have seen traffic decline on their websites. A few exceptions include leading crypto exchange Binance, and controversial exchange FCoin, which launched a new revenue model called “trans-fee mining.”

Coinbase’s co-founder and chief executive officer Brian Armstrong has last month revealed he isn’t affected by the bear market, and presumably by declining traffic, as it uses the “down cycles to build a strong foundation,” so as to thrive when the bullish run comes.

5/ After many years of this, I've come to enjoy the down cycles in crypto prices more. It gets rid of the people who are in it for the wrong reasons, and it gives us an opportunity to keep making progress while everyone else gets distracted.

— Brian Armstrong (@brian_armstrong) June 19, 2018

Coinbase’s problems may not just be related to the bear market, however, as various companies have launched competing platforms. Square’s Cash app has recently started letting users buy and sell bitcoin without charging fees, and made $200,000. Stock trading app Robinhood has also launched Robinhood Crypto, allowing its millions of users to buy and sell cryptocurrencies without dealing with fees.