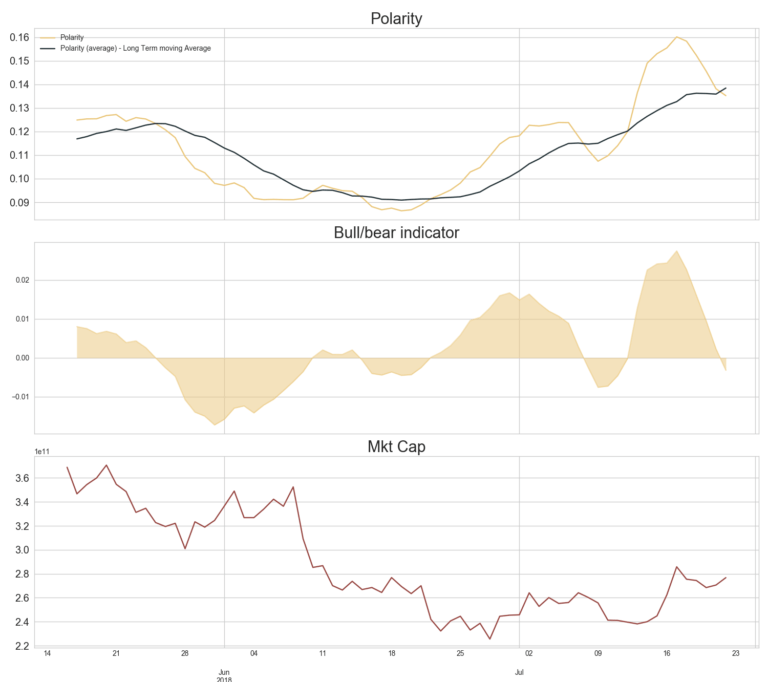

The sentiment graph shown above is calculated using algorithmic text analysis which classifies a Tweet as positive or negative on a scale from +1 to -1. This analysis is conducted for all tweets related to over 100 cryptocurrencies. Aggregating the sentiment over these cryptocurrencies gives an indication of the bullish or bearish sentiment of the market as a whole. For more frequent updates on sentiment visit AltcoinAnalytics.

Overall sentiment is still at relative high levels, in part due to the Bitcoin ETF announcement that is expected on August 10th. However, sentiment shows a recent decrease from the highs last week.

Sentiment Update

The sentiment indicator has overall still been at relatively high levels but has shown a decrease very recently – ahead of the break past $8,000.

The bull/bear indicator is based on quantitative analysis and looks at the change in sentiment rather than the current sentiment level. Moreover, it values changes in positive and negative sentiment asymmetrically, reflecting the fact the negative news (FUD) spreads faster than positive news. Looking back the indicator has made some interesting correlations – becoming distinctly bullish since mid-June. The indicator spiked to bullish over the last couple days which preceded the ongoing bitcoin rally. According to CryptoCompare data bitcoin has appreaciated 28% in the last two weeks.

Sentiment Crypto websites

Sentiment on crypto news websites has shown some decrease – while the consensus has been relatively stable.

Individual Cryptos

Taking a closer look at the micro level certain cryptoassets show trends. The individual Sentiment overview shows the following AltcoinAnalytics quantitative indicators over time:

- Market Capitalization

- Sentiment (polarity)

- SumConviction: Sentiment proxy taking in to regard exposure and certainty

- Folthsent: Sentiment of Tweets for which the author has a certain threshold of followers, this to put more weight in more followed Twitter accounts

- Folth: Exposure by Tweets with a certain threshold

- Recip: Tweets * followers, again a proxy for the Twitter exposure of a certain crypto

Bitcoin cash (BCH) shows a sharp decrease in sentiment. There is a clear slump in Twitter sentiment – which reflects a substantial decrease in the coin’s market cap over the last two months.