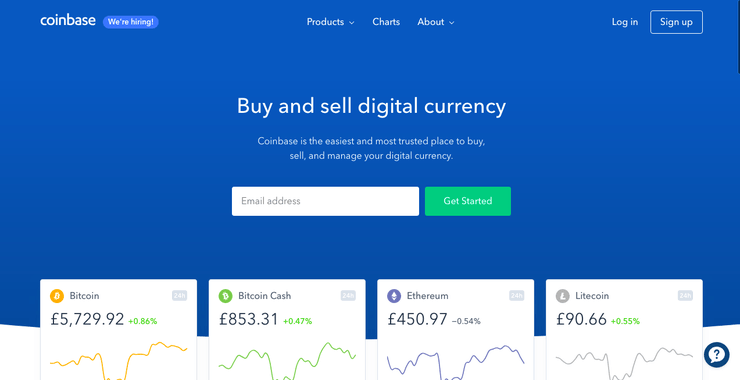

An internal investigation conducted by popular San Francisco-based cryptocurrency exchange Coinbase reportedly found that there was no insider trading ahead of its Bitcoin Cash (BCH) listing, despite a suspicious price rise.

According to Fortune, the exchange hired two “well-known” US law firms to conduct a “months-long probe” to find out whether insider trading took place. Last year, Bitcoin Cash’s price surged, shortly before Coinbase publicly announced it was listing the cryptocurrency.

This saw various analysts point to insider trading, as those who knew about the listing were likely stocking up to take advantage of the price rise cryptos listed on the San Francisco-based exchange see.

Addressing Fortune, a Coinbase spokesperson restated that the company would “not hesitate to terminate an employee of contract and/or take appropriate legal action” if evidence pointed toward insider trading – a stance the company’s CEO Brian Armstrong took last year.

The investigation, however, reportedly revealed no insider trading took place. The spokesperson was quoted as saying:

We can report that the voluntary, independent internal investigation has come to a close, and we have determined to take no disciplinary action.

An anonymous source close to Coinbase further revealed that a staff lawyer discussed the investigation’s outcome with employees during a meeting last week, presumably meaning the cryptocurrency’s surge prior to the announcement was merely coincidental.

Notably, Coinbase’s initial attitude towards Bitcoin Cash was dismissive, as when the cryptocurrency forked from the Bitcoin blockchain it told users who wanted it to look elsewhere as it wasn’t planning on supporting it.

Later on, it revealed it distributed the “airdropped” BCH to users who held BTC on its platforms at the time of the fork, so they could withdraw their funds and use them elsewhere. In a surprising move, Coinbase then announced it was adding BCH to Coinbase and the Global Digital Asset Exchange (GDAX), which since rebranded to Coinbase Pro.

A flood of trades filled its orderbooks, to the point Coinbase was forced to temporarily halt Bitcoin Cash trading altogether. At the time, Armstrong answered public outcry over insider trading by claiming Coinbase would fire and take legal action against any employee who leaked confidential information.

I just published “Our employee trading policy at Coinbase” https://t.co/ydT9cTAdPR

— Brian Armstrong (@brian_armstrong) December 20, 2017

The investigation doesn’t clear coinbase, however. A class action lawsuit was filed against it last year, by customers accusing the company of negligence and consumer protection law violations. Lynda Grant, a lawyer representing the plaintiffs, added that she believes the US Commodity Futures Trading Commission (CFTC) is investigating the exchange over the BCH incident.

To prevent a similar scenario, Coinbase recently announced it was considering adding five new cryptocurrencies so users are aware: Cardano (ADA), Basic Attention Token (BAT), Stellar Lumens (XLM), Zcash (ZEC), and 0x (ZRX). After being mentioned, all five tokens saw their prices rally in anticipation.

The San Francisco-based exchange recently established a political action committee (PAC), an organization formed to raise funds on behalf of candidates running for public office. Its ads also recently returned to Google and Instagram, in a significant policy reversal.