NEOUSD Medium-term Trend: Bearish

Supply zones: $70.00, $80.00, $90.00

Demand zones: $40.00, $30.00, $20.00

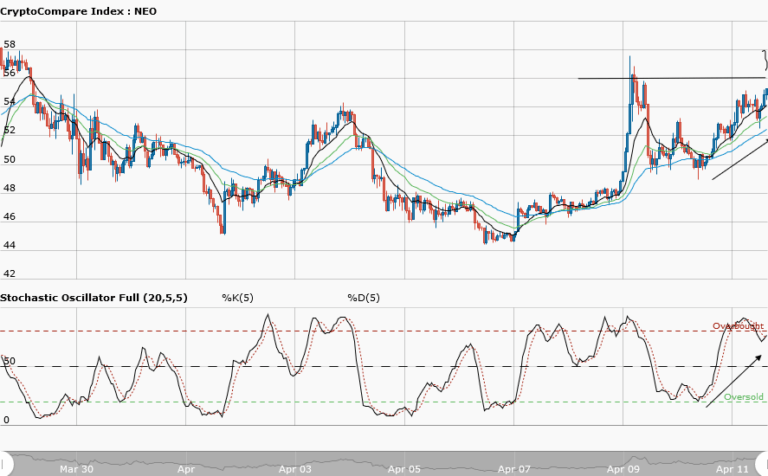

Neo‘s bearish trend continues in the medium-term outlook. The bears continue to dominate the market with strong momentum creating lower lows in price. The bulls barely pushed the price to the $50.00 supply area, which happened to be a nice retest at the area for the bears. They staged another strong comeback and the price got to a fresh demand area at $47.51. You can see the upward bullish rejection at the 12-day EMA which is a clear evidence of the bears’ presence. The daily candle opened bearish below the three EMAs crossover – and the three EMAs are fanned apart. These suggests that there are more sellers in the market.

The trend as you can see is a downtrend. The stochastic oscillator is in the oversold region with the signal pointing up which means an upward momentum in price. This implies that we may see some bullish movement but these should be seen as pullbacks for a market correction in a downtrend continuation. As the downtrend resumes after the likely pullback, the $45.00 demand area is the bears’ target and this may happen very soon.

NEOUSD Short-term Trend: Ranging

Neo is consolidating in the short-term. The bulls lost momentum after dragging the price to the $51.00 supply zone paving the way for the bears’ return. The journey to the south by the bears was smooth as the demand areas at $48.60 was visited and finally stopped at $47.50. This area became a strong support, as you can see it. The formation of a double bottom in this area brought back the bulls. Currently, the price has been pushed higher as the bulls increase their momentum. Neo is trading between the upper supply area at $51.00 and at $47.50 lower demand area. The key strategy here is patience. Traders should wait as the pair will certainly breakout to the upside or breakdown to the downside before riding the trend.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.