NEOUSD Medium-term Trend: Bearish

Supply zones: $70.00, $80.00, $90.00

Demand zones: $50.00, $40.00, $30.00

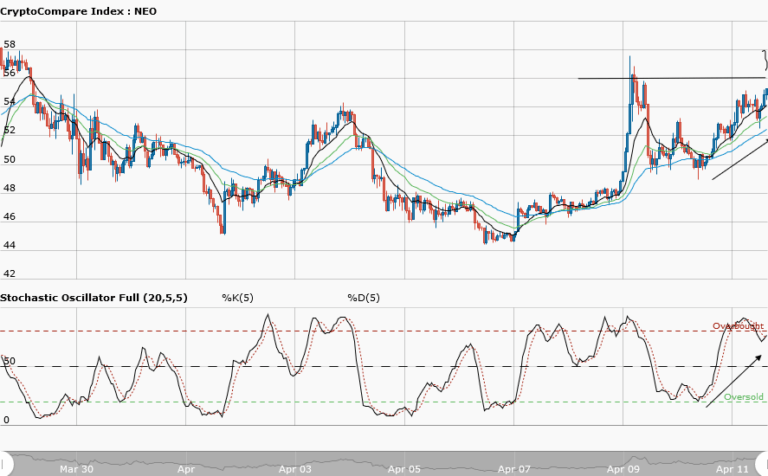

Bearish trend returns in the medium-term outlook of Neo. The bears successfully won the consolidation and broke the $57.00 lower demand range of yesterday’s analysis. Patience really paid off in the long run. Rejection of the bulls’ upward push at $60.00 by the bears could be seen around the 12-day EMA. This led to an increase in the bears presence and pressure that pushed the price down to the demand area at $55.00. The price is below the moving averages crossover, likewise, the three moving averages are fanned apart which connotes strength in the context of the trend – in this case the downtrend. The daily candle candle opened bearish at $56.78 against yesterday’s opening of 62.45. This simply implies that more sellers are present and may likely push the price further south as the momentum increases. The bears’ target of $50.00 may still be sacrosanct in the medium term

NEOUSD Short-term Trend: Bearish

Neo remains bearish in the short-term. The increase in momentum by the bears led to a continuous downward movement of the price to the $55.00 demand area. Each effort by the bulls to stage a comeback was faced with stiff rejection by the bears, especially at major zones. Just as we had lower highs and lower lows yesterday we are likely to see a repeat of this today as the bears’ momentum increases. The stochastic oscillator has left the overbought region and signal pointing down suggesting downward momentum in price as bears kept the pressure up.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research