NEOUSD Medium-term Trend: Ranging

Supply zones: $80.00, $90.00, $100.00

Demand zones: $50.00, $40.00, $30.00

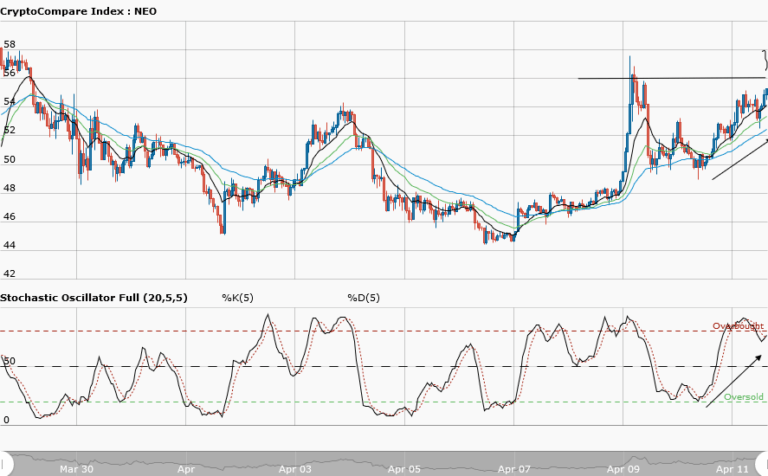

Neo goes into ranging scenario in the medium-term outlook. The $69.00 supply zone target was a mirage to the bulls as they lost momentum and manage to push price barely to the $66.50 supply area. The formation of an inverted hammer at this area means trend reversal. The bears came in and pushed price down to the $60.00 demand zone below the three moving averages crossover, breaking the upward trendline of yesterday analysis thus put Neo in a ranging situation. Daily candle opened bearish at $62.45 against yesterday opening of $63.07. This suggests more bears are in the market. Stochastic oscillator upward momentum was rejected and now points down. This connotes further downward price movement as the bearish momentum increase. Neo is ranging between the upper supply area at $66.50 and the lower demand area at $57.00. Traders should be patient in this consolidation scenario for a breakout from the upper price range to go long or for a breakdown at the lower demand range to go short.

NEOUSD Short-term Trend: Bearish

Neo is bearish in the short-term. The loss in momentum by the bulls at the $66.00 supply area brought the bears back to the market. The bears kept pushing price lower to the demand area at $60.00 where the price currently consolidates. From the chart, you can see price is forming lower highs and lower lows that are characteristic of a downtrend. The stochastic oscillator was rejected for upward momentum and now points down meaning further downward price movement as the bears’ pressure increase. As more bearish candles formed and close below the moving averages crossover, Neo may likely provide more lower highs and lows in the short-term

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.