NEOUSD Medium-term Trend: Bearish

Supply zones: $80.00, $90.00, $100.00

Demand zones: $50.00, $40.00, $30.00

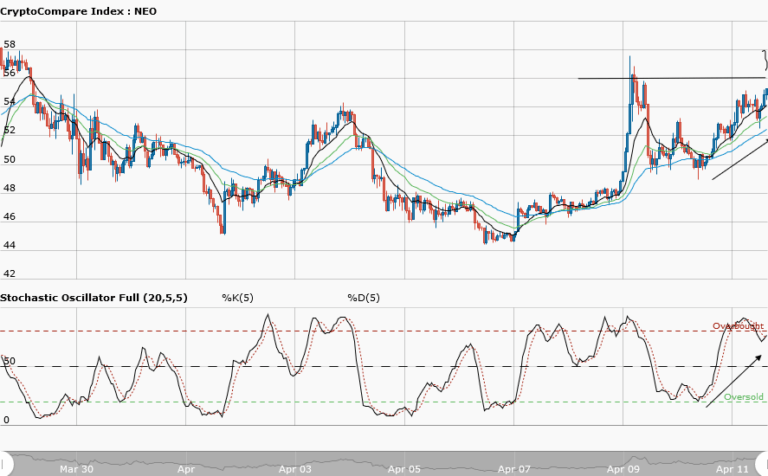

The downtrend continuation in Neo in the medium-term is still valid. The bears’ dominance is still intact as they pushed the price down to the $62.00 demand area many times. The bulls comeback at this demand area was strong as they pushed the price up to the supply area after breaking the downward trendline. The bulls failed to sustain the momentum past this area. This created a double top formation that led to the bears pushing the price down. The price at the supply area is the second touch it will be making after breaking down from the $70.00 supply area. A break is not likely as it requires four touches before a breakout to the upside could happen. As a result, the bears’ presence and pressure might continue to push the price down.

The stochastic oscillator has left the overbought region and is going down towards the oversold which connotes downtrend momentum. The daily candle opened at $65.34 lower than yesterday’s opening of $68.09. This further confirms that more sellers are in the market and the price may likely go further south.

NEOUSD Short-term Trend: Ranging

Neo continues ranging in the short-term. The bears did not have enough momentum to drag the price further down the lower demand area of yesterday’s range of $62.00. The price was mainly in the $63.00 demand area. This lead to the bulls setting in with stronger momentum and pushing the price up to the upper supply zone at $69.00, before the bears set in again for another price push to the south. The struggle for dominance in the short-term outlook between the bulls and the bears will continue until a breakout or breakdown occurs. Traders should patiently wait for either before taking a position.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.