NEOUSD Medium-term Trend: Bearish

Supply zones: $80.00, $90.00, $100.00

Demand zones: $50.00, $40.00, $30.00

The downtrend continuation in Neo on the medium-term is valid. As mentioned yesterday, a more bearish move will be seen in the market as the bulls lost momentum at the $77.00 supply area. This gave the bears more control as they made a strong comeback and pushed the price down breaking the $70.00 demand zone, retested and went down again to the $65.00 demand area breaking it again.

The daily candle opened bearish and below the three exponential moving crossovers. This connotes the bears’ presence and pressure and a further possible downward push. The three exponential moving averages are fanned apart and this means strength in the context of the trend, in this case the downtrend. As the downward momentum increased and more bearish candles formed and closed below the three exponential moving averages, the $60.00 demand zone may be the bears’ target in the medium-term.

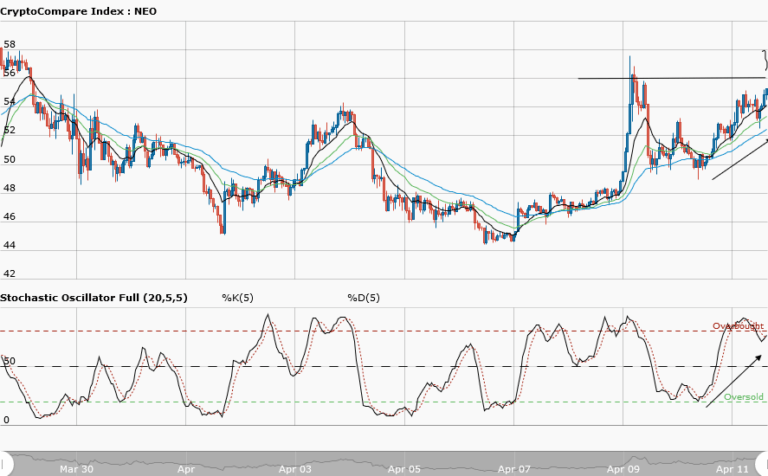

NEOUSD Short-term Trend: Bearish

Neo returns bearish in the short-term. The bears’ control of the market was firm as the bulls’ presence fades away. The bears broke the lower price range ($75.00) of the consolidation and set Neo up on the journey to the South. Their pressure pushed the price further down to the $64.00 supply area. The daily opening price was $71.18 against yesterday’s $76.38 opening. This is confirming the presence of more sellers than buyers. The price is forming lower highs and lower lows that are synonymous with a down trending market.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research