ADAUSD Medium-term Trend: Bearish

Supply zones: $0.3500, $0.4000, $0.4500

Demand zones: $0.2000, $0.1500, $0.1000

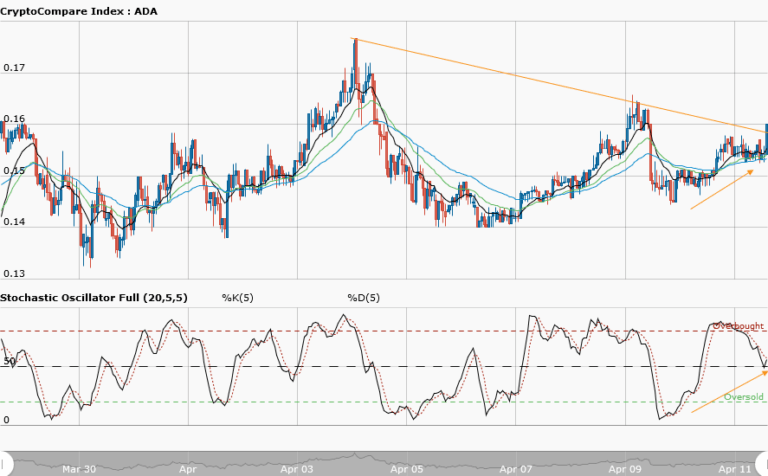

The bearish trend for Cardano continues in the medium-term. The bears sustained the momentum as all efforts by the bulls to stage a comeback were thwarted. The $0.2500 demand zone predicted yesterday for a retest was reached but could not be broken by the bears. The bulls thereafter came and pushed the price to the $0.276 supply area. Rejection for a further upward push was made possible by the bears as they pushedthe price down again below the three exponential moving averages crossover. The price bounced off the downward trendline. This is due to the bulls’ loss of momentum to muscle a breakout every time they get to this point.

The stochastic oscillator was rejected for upward momentum and now points down – signaling downward momentum. The daily candle opens bearish at $0.2651 compared with yesterday;s opening of $0.2811. This means that more sellers are in the market to further take price south. The Bears’ target may likely be to retest the demand zone at $0.2500 again, break it and take the price to the $0.2000 target in the medium term.

ADAUSD Short-term Trend: Ranging

Cardano is still consolidating in the short-term. The bears’ pressure was strong as they broke the lower demand area of yesterday range but the bulls were quick in response and never allowed a retest for further downtrend continuation. We can see from the chart a long bullish candle closes above the $0.2550. The bulls succeeded in pushing the price to the $0.27500 supply area twice. This led to the formation of a double top at the supply area and the bears came back. Patience again is required as Cardano is still consolidating in the short-term. A clear breakout or breakdown will occur shortly.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research