The year is 2020 and John McAfee was absolutely right in his prediction: Bitcoin had passed the $1 million price per unit, the entire crypto market is soaring, and regulators finally decide that this kind of phenomenon has grown out of proportion and has to be stopped by any means. The banks are unhappy that an increasingly large number of their clients are closing their accounts to manage their funds by themselves through a phone wallet app, the governments feel worried that their fiat is used in payments to a lesser extent, and something has to be done in order to save the financial system before it crashes and burns due to this unpredictable wave of innovation.

Politicians themselves and important figures from economics have lost credibility since all of their warnings have proved to be wrong in the long term, and citizens are become increasingly educated on their economic freedoms and much more aware of their power.

There’s a sense of revolution in the air, but the elites are not going to allow it: if overtaxation doesn’t suffice and still doesn’t deter people from investing in that bubble which doesn’t seem to burst, then stricter policies have to be put into practice.

National and international financial institutions evaluate their odds of taking down the likes of Bitcoin or Monero, realize that they don’t possess the hash power to run successful attacks on the blockchain, and settle with the only trustworthy weapons they’ve ever had: propaganda, media witch-hunting, and stigmatizing.

The university graduate who bought 0.1 BTC for $500 in 2017 and now holds an asset that’s worth 200 times more is no longer a visionary and a wise investor who saw potential in emerging technologies and had enough patience to see them grow. No siree, they’re going to transform him or her in an enemy of the state who potentially funds terrorist organizations, supports international drug-trading cartels, and regularly avoids paying taxes.

However, this is only the case for liberal democracies where these citizens still hold some fundamental rights. In the case of authoritarian states like Russia, China, Turkey, or Algeria, penalties can even include imprisonment without a trial, a sentence to forced labor (disguised as community service), and physical punishment. Confiscations of cryptocurrencies are not out of the question in either situation, as the state must seize the dangerous means before they get to terrorist organizations, drug lords, or other hostile nations which aren’t part of the same military alliance.

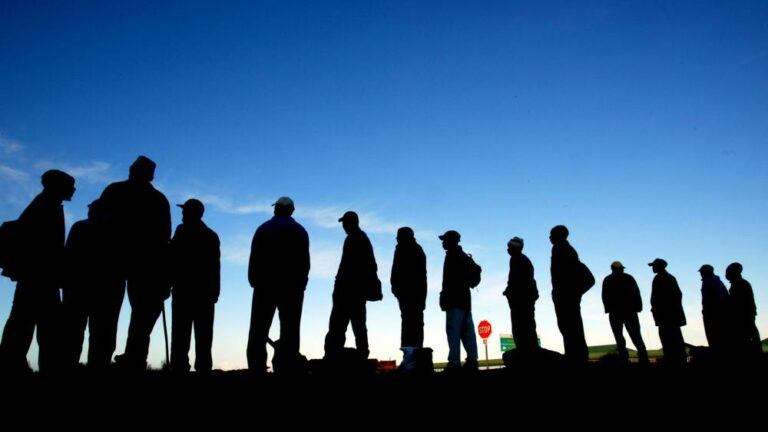

If this type of witch hunt against cryptocurrency holders ever happens, it will cause citizens to flee the country and seek exile in friendlier places.

This is one very important aspect which governments, regulators, and banks have to take into account when they make extreme decisions against a phenomenon they cannot thoroughly understand:

Those who work and invest in cryptocurrencies at this early stage are some of the most capable and educated of their citizens, whom they can’t afford to lose.

While there certainly is an ideological bias which helps those with anarchist views express their disdain and a number of crime-related activities that cryptocurrencies facilitate, the risk of going against early adopters, coders, engineers, and people doing other related works is that of losing some of your brightest minds and most skilled workers.

It’s true that everyone mines, creates, buys or holds cryptos with speculative intentions. Yet it takes a certain degree of open-mindedness, critical thinking, and technical understanding to be able to view Bitcoin and its siblings as brilliant inventions whose intrinsic value is given by their resistance to censorship and central control.

If you as a highly-ranked government official can’t have a proper dialogue and establish an open convention for cryptocurrencies, then you’re going to see many valuable people go.

The assumption of migration and brain drain isn’t just based on financial incentives – even though those are very important. If you buy a BTC today for $9000 and it 2 years it’s worth a million, then you will want to go to a place where you can use that financial power to improve the quality of your life. But then again, as a citizen you want to feel like you belong into the country where you live and work, you want to be treated by your government with a degree of transparency and openness, and you want a justification for the taxes that you pay.

If the Leviathan to which you’re giving tax money insures your safety and helps provide great education and excellent healthcare while you’re treated like an honest citizen, then you have no reason to leave. But if you become stigmatized and receive an ideological “enemy” label, then it’s time for you to move somewhere else.

The real winners of these hypothetical witch hunting activities are governments which show openness and appreciation to cryptocurrency enthusiasts.

In many ways, it would be as if the 19th century industrialists got arrested for creating wealth in unusual ways and destroying the previous norms of society. Maybe cryptocurrencies aren’t as influential and revolutionary for the evolution of humankind, but they certainly disrupt something that’s essential for governments: trade and finances. Furthermore, they facilitate the anarcho-capitalist principle of separating the money from the state.

But if a government is really smart and has a long-term vision, it will make sure that it embraces innovation and becomes among the first hubs that welcome disruptive technologies. Even if the projects fail to reach their goals, they can still benefit from some of the brightest minds of our times. They can help write the history of humanity. Your economy will grow thanks to investments, your education will improve, and the strength of your international financial markets increases proportionally.

Many legislators and high-ranked politicians don’t realize it, but the emergence of crypcocurrencies can change world finances whether they like it or not.

And such paradigm shifts also shake the balance of power and create a new equilibrium in global politics. Western European states have grown thanks to their colonialism and embracement of the industrial revolution; the US and Japan have secured their super power positions through technological innovation; Russia has used its resources and ideology to grow as an empire,;and China has become the ultimate outsourcing hub in order to attract foreign capital.

Now it’s time for countries of the world to look into the future, see the potential of decentralized cryptocurrencies and how important it is to them to actually have developers and owners of these assets within their territories.

If cryptos are digital gold, then it’s definitely a good idea to make sure that large amounts are traded within your territories and you have a convenient way to exchange to your national fiat. The first is a way of attracting investors, the latter is a smart method to preserve your centralized currency and legitimize it in a new era of valuable code.

If they want to gain an edge and develop a new layer of competitiveness in global markets -smart governments must integrate the new into the old and find balance between them.

It’s the way we have always progressed: when automobiles were first produced, they quickly got integrated into the streets that were dominated by horsecarts. When airplanes allowed people to travel long distances in previously unimaginable times, they became an alternative which was inegrated into the transport system. And now when cryptocurrencies are evolving towards technological maturity and develop true censorship resistance – it’s time for governments to make smart integrations.

Putting the “commodity” or “security” label on the likes of Bitcoin in order to avoid the “currency” definition is short-sighted and only a way of stalling the unavoidable.

Cryptos must be acknowledged for what they are, integrated into the financial system to fulfill their potential, and accepted as the future of paymants. They will never replace tangible goods, they will never have the physical properties of gold and won’t take the place of national currencies in the near future. But they can bring some economic and political advantages which governments had better understand and take advantage of.

The bad news is that the diversity of political regimes around the world and the differences in culture will definitely generate some stigma around something that’s borderless and global by its very nature. Therefore, some heads of state will seek to ban every activity related to cryptocurrencies and punish those who possess financial assets that aren’t the national central bank-issued coins and bills.

That’s where the exodus of open-minded, smart, and capable people begins, and that’s something that other smarter governments should understand and profit from. And by the time all of this FUD, confusion and persecution get settled, we will have a completely new economic order on a global scale. Those who knew how to profit from the context will have a greater authority, more brilliant minds in their territories, better education, and probably more welfare.

Which side do you think your government is going to be on and what would you do if tomorrow you were told that all of your cryptos had been confiscated?