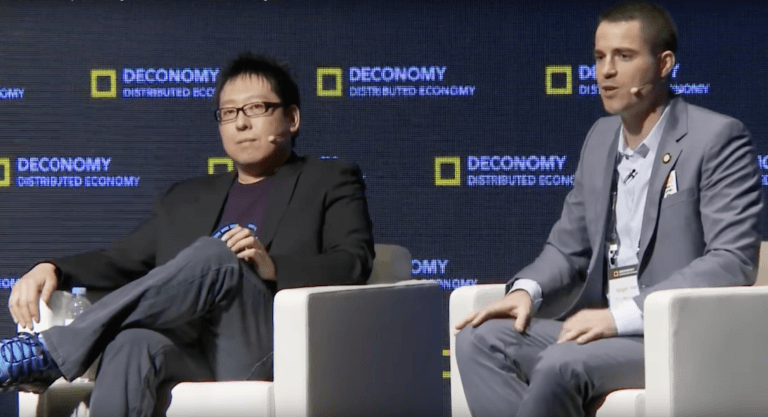

If you have a Twitter account and follow some of the most influential names in crypto, then it’s almost impossible not to stumble upon memes and bits from the recent Bitcoin scaling debate which took place between Roger Ver and Samson Mow at Deconomy 2018. While the discussions are not representative for the technologies and solutions that they advocate for and are highly correlated with every individual’s charisma, it’s important to point out some objective facts and bring some balance into the debate.

First of all, I would like to argue that the clash between the two advocates of the main Bitcoin visions was a complete failure which shouldn’t be regarded as a permanent reference. The chemistry between Roger and Samsom is interesting, to say the least, but the former is an experienced speaker and long-time advocate for Bitcoin who has been consistently touring the world to present the technology at conferences, while the latter is clearly a more introverted person who deems mathematical facts to be more important than rhetoric. In other words, the Bitcoin Cash evangelist deserved a likewise incisive and assertive debating partner. A good debate presents opposing views which become complimentary in the process, and that’s definitely something we didn’t get.

Secondly, beyond the differences of background and personality, there also seems to be a language and cultural barrier. Roger Ver was direct, unforgiving and bold in his criticism of Bitcoin, but also seemed to have a clear plan to pitch his product to the public, being fully aware that the debate would be recorded and distributed on the internet. Conversely, Samson seemed nervous and insecure in body language, a little too ironic in speech, and inconclusive in regards to the scaling solution that he advocates for. There were times when the Blockstream CEO would be lost for words and look like somebody who isn’t a native English speaker, as he’s made several grammar mistakes and had trouble keeping up with Mr. Ver’s aggressive style.

The argument which results from these two main assertions is that the choice of a debate partner for the Bitcoin Cash founder was uninspired and unfair. An introvert who acts as if certain technological facts are self-evident and has limited experience in debating (or at least has a hard time keeping up with a more aggressive style) will always have a hard time arguing against a professional salesman who has been going to conferences to advocate for Bitcoin for over 7 years. In such a context, the outcome is in the favour of the better speaker, even though we need a little more objectivity in the crypto space. It would have been desirable to have a more heated and productive exchange, which would help everybody understand a little more about the pros and cons. However, there is no point in undergoing metaphysical analysis and only the comments that have been made throughout the debate are the ones to get mentioned.

Why Roger Ver Won the Debate

Okay, maybe that this is an unpopular opinion among hardcore supporters of Bitcoin who had a lot of fun sharing the clip where Roger claimed the slow adoption of Bitcoin led to the death of children. I agree, that statement is a little too extreme, self-righteous in relation to the purpose of cryptocurrencies, and meant to appeal to the emotions of an audience which consists of people with computer science backgrounds who seek tech facts and may not be as easy to manipulate as the regular guy who has no idea why block size matters in a blockchain.

However, Roger Ver doesn’t speak for the computer geeks who know the difference between mining algorithms, run full nodes, and can tell the difference between block sizes. The Bitcoin Cash mastermind spoke for the masses, for those who might become interested in the field, and for those who honestly don’t care much for the technology and want to make money. Taking what’s proven to work over the years and scaling it in ways that aren’t necessarily sustainable phisically and energetically definitely sounds more appealing to larger audiences than experimenting with a new technology which deviates from the original vision for the sake of innovation. And there’s a reason why there’s “Cash” in the name, after all.

In his discourse, Mr. Ver has started from the classical “original vision of Satoshi” argument and gradually displayed his understanding of economics, his belief in transactions with negligible fees, and his commitment to offering improvements to the technology that has worked over the last 9 years. Because the average crypto investor will not care about the consequences of having large blocks and will show very little concern for the centralization involved in the process, as the premise of supporting the Bitcoin version that’s currently better suited for payments sounds way more promising in financial terms.

His argument to end all criticism was a reference to Moore’s Law, which states that the number of conductors in microprocessors doubles every year. When Samson said that blockchains don’t really scale, Roger Ver has quickly thrown the scalability solution on the shoulders of technology companies. According to this line of thought, it’s not the software that has to be improved and optimized for the sake of running better on current hardware and anticipating future upgrades, but the responsibility of the hardware developers to make the software lesser resource-consuming.

Mr. Ver also used his knowledge of libertarian economics to his advantage, he acknowledged the merits of Vitalik Buterin as a blockchain innovator (probably as a sneaky way of letting everyone know that he’s in good terms with the founder of the second biggest cryptocurrency in the world) and made plenty of accusations which never received a proper and direct answer. If you count his confidence and surprisingly likable persona, you completely understand why this guy can get away with appropriating the Bitcoin brand name and making claims about knowing the original vision.

Why Samson Mow Lost the Debate

To put it plainly, Samson didn’t really give any straight answers in regards to the Lightning Network and was inefficient whenever Roger Ver fired venomous arrows at him. He wasn’t even able to say “We shouldn’t make this kind of comparison just yet, the Lightning Network has been on the Bitcoin main net for only a couple of weeks, give it time and it will grow because there’s a lot of trust revolving around it.” when the Bitcoin Cash advocate has mentioned that the number of merchants who accept Bitcoin payments was decreasing.

By not having a proper response to the accusations, Samson has pretty much validated them. He didn’t deny the fact that the Bitcoin dominance has decreased substantially since the fall of 2017 due to the ridiculously high transaction fees, he had no good justification for the decreasing number of merchants who accept Bitcoin payments, and couldn’t even present a plan for the Lightning Network (other than launching his own hat shop).

The best he did was to point out the philosophical difference between the Keynesians who think that cryptocurrencies should be spent as part of the economic framework (and Mr. Ver is one of their best representatives), and those who view cryptos as an upgradeable digital gold – a store of value which can be improved through the Lightning Network in order to enable instant and cheap transactions. This was a classic clash between a SPEDNer and a HODLer, except that the skillset of the participants is not even and generates a clear advantage for the better speaker. And yes, Samson could have had better chances if he was a more confident and assertive debater who doesn’t shake his leg and play with his plastic bottle to show how uncomfortable he feels. Body language also matters when presenting an argument, and Bitcoin Cash fans were quick to associate his nervousness with the behavior of a liar – which might not be the case, but it still doesn’t mean that appearance doesn’t matter.

Finally, there’s the argument about attitudes: Roger Ver was like a boxer who’s fighting a fellow heavyweight for the world title, while Samson acted like he’s too cool for this debate, has an ace up his sleeve that he won’t reveal, but has the power to automatically make Roger’s arguments invalid. One tried to sell his product and did a great job making it look great, while the other thought it was self-evident that he represents the better vision. When the Bitcoin Cash-supporting @Bitcoin Twitter account posts moments from this debate, millions of people who have no idea about technicalities will be charmed by the charisma of Roger Ver and think that they should be getting Bitcoin Cash. And it’s unfair because Bitcoin didn’t get a proper representation and there wasn’t enough positive argumentation for the advantages of SegWit and the Lightning Network.

While Roger shone bright and made some valid claims about the current problems of Bitcoin (his version of the coin is the better short-term solution for cheap transactions), Samson played it cool and acted as if he’s won the debate before it even started just because the Lightning Network works and had been released on the main net quicker than expected.

And that’s the biggest problem in the space: some developers and engineers don’t have a strong charismatic presence, and this lack of social skills doesn’t quite help them become likable to the masses. That’s how people like John McAfee become influential with their shilling tactics and go as far as asking for thousands of dollars for coin endorsement services. This might be an extreme example which is unfair to both Roger Ver and Samson Mow, but it reflects the state of the cryptocurrency medium and the way it looks to some unknowledgeable fellows.

Good technologies require better spokespeople and advocates, and the developers need to understand that reaching mainstream adoption is about more than a good technology with a friendly user interface. VHS has beaten Betamax and Laserdisc for a series of reasons, and we shouldn’t settle for the inferior solution just because of better marketing. Cryptocurrencies are all about innovation, freedom, and meritocracy, and it’s our responsibility to make sure that the best product wins on all fronts. And for that purpose, we should demand for better debates, especially when the credibility of Bitcoin is at stake.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.