Malta has recently proposed the creation of tests to determine whether assrts launched through initial coin offerings (ICOs) can be defined as securities.

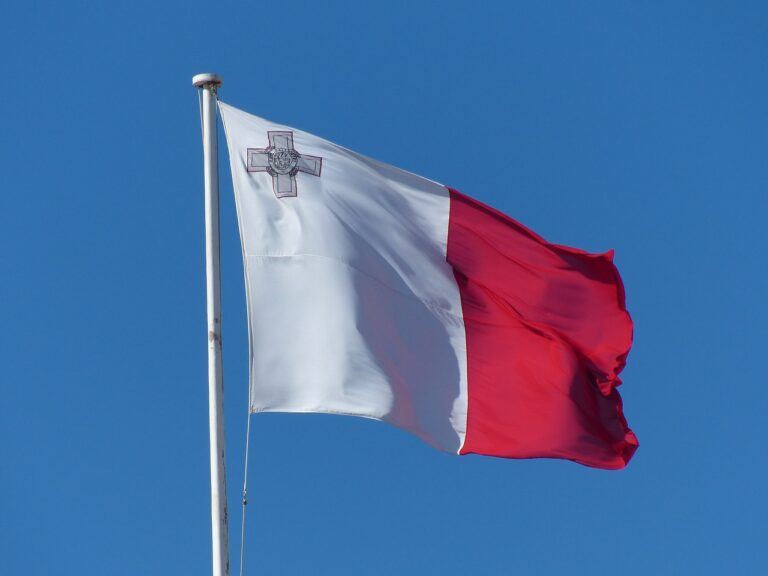

The island off the coast of Sicily may become the first nation in the European Union (EU) to put forward assessment protocols to measure the credibility of ICOs, while also affording investors a greater level of security through its proposals this week.

In a report published by the Malta Financial Services Authority (MFSA), assessing how tokens should be classified using a multiple stage process would create a better level of security for investors..

The success of Malta’s assessment process may, by the reports’ own admission, see other EU members implement it.

“This Consultation Paper presents an analysis of the definitions of the financial instruments listed under Markets in Financial Instruments Directive 2 (‘MiFID’) as well as their relevance and implications to DLT [distributed ledger technology] assets. The methodology underpinning the Test’s determination as well as the considerations which should be taken into account within the context of the EU and national legislative frameworks are also presented.”

DLTs within Malta will come under a two-stage examination which will help find the right classification for each, on a case-by-case basis. Specific blockchain technology applications or tokens can be exempt from further regulations. In some cases, they may enter the second stage of examination, where the token or DLT would be assessed against different kinds of securities.

The report reads:

“It is being proposed that the Test will consist of two stages, wherein the first stage would effectively determine whether a particular DLT asset qualifies as a Virtual Token (‘VT’)3. Subject to a negative determination during the first stage, the second stage would determine whether the DLT asset would qualify as a financial instrument under Section C of Annex 1 to MiFID.”

Any token or asset that undergoes these stages of testing may be classified under existing Maltese and EU regulations. During the second stage of testing, these tokens can then be placed under more specific securities categories.

Tokens or DLTs that fail the second stage of testing will then be subject to a third line of assessment. Those that come under this line of testing will be placed under the regulatory oversight of the proposed Virtual Financial Assets Act (VFAA).