Wall street strategist Tom Lee has updated his bitcoin price prediction and believes the crypto-asset will hit $91,000 by March 2020.

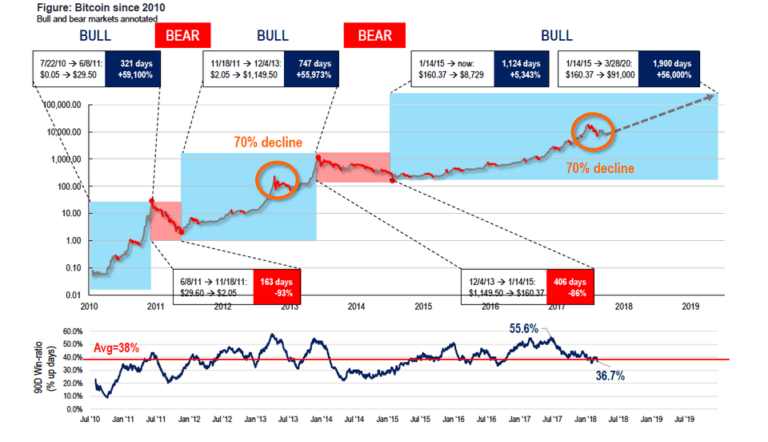

As reported by Forbes recently, Tom Lee and Fundstrat use a logarithmic chart to explain their prediction. According to Fundstrat, the data collected for the updated prediction included: the cost of mining bitcoin, daily, hourly and monthly trading trends as well as more old fashioned technical analysis, which is the study of charting patterns to discern probable price movements.

The chart highlights previous bear markets of over a 70% decline; since December, the bitcoin price has suffered a 70% decline from its peak of $20,000. The chart suggests that once a bottom has formed a bull run will likely carry bitcoin to a high of $91,000 by March 2020.

In July 2017 Lee predicted Bitcoin would hit $55,000 by 2022, the more recent prediction shows Mr Lee is more bullish on bitcoin than ever. Recently he released his “Bitcoin Misery Index”, he suggested that the contrarian index was indicating that bitcoin was a strong buy.

However, according to Tom Lee and Fundstrat, the same cannot be said for the majority of the over 1,600 cryptocurrencies that will suffer a “significant shakeout”. Mr Lee argues that large corporations will only put money into a select few crypto-assets such as bitcoin and ethereum and not intot the long tail of smaller crypto-assets.