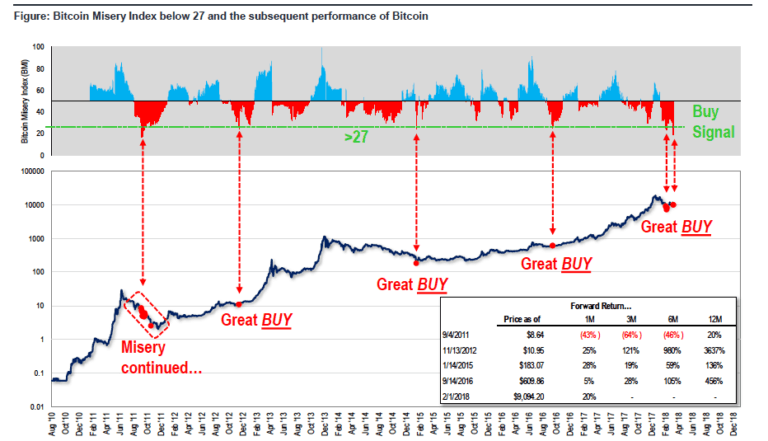

Bitcoin bull Tom Lee, the only Wall Street strategist covering Bitcoin and the co-founder of Fundstrat Global Advisors, recently created a “Bitcoin Misery Index.” The index works like most sentiment indicators, and is meant to be a contrarian one. This means that when it’s low, it’s time to buy the cryptocurrency. The index ranges from 0 to 100, and is now at 18.8.

According to Tom Lee, when the misery index hits “misery” (falls below 27), bitcoin sees “the best 12-month performance.” In the past, bitcoin has experienced several bull runs after falling below the 27 mark. Its current value of 18.8 is the lowest it’s been since September 6, 2011.

The Bitcoin Misery Index takes into account several factors. Among them are the number of winning trades out of the total, and the cryptocurrency’s volatility, according to Tom Lee. He said:

“The BMI [Bitcoin Misery Index] is telling us to keep the negative headlines in perspective. When the BMI is at a 'misery' level, future returns are very good.”

Lee’s report and new misery index come at a rough time for bitcoin and the cryptocurrency ecosystem in general. One of the biggest cryptocurrency exchanges, Binance, just faced hacking rumors while it thwarted a ‘large scale’ theft attempt. Japan’s Financial Services Agency (FSA) suspended two cryptocurrency exchanges for one month, as the result of poor security and compliance standards.

Moreover, Mt Gox trustee Nobuaki Kobayashi revealed he has sold roughly 35,800 BTC and 38,000 BCH, which roughly equals $405 million taking into account the dates in which these coins were sold. Kobayashi is still in possession of about 160,000 BTC, and further liquidations could be coming.

In light of these events, bitcoin’s price has been declining in the past few days. At press time, the flagship cryptocurrency is down by 3 percent, and is currently trading at $8,800, according to data from CryptoCompare.

Speaking to Barron’s, Tom Lee revealed that the Mt Gox liquidation, depending on tis magnitude, could be painful in the short term, but not a deal breaker. To the Wall Street strategist, some of the money bitcoin is being sold for will end up coming back.

In his report, Lee maintained his $20,000 mid-year bitcoin price target, and his $25,000 year-end target.