Comment of the Day @aantonop

I heard that a dancer in Vegas has a bitcoin QR code tattoo and all I could think of was…

I hope it is a temporary tattoo because they might want to upgrade to a bech32 native segwit address to save on fees. Also address re-use is poor privacy.

— Andreas M. Antonopoulos (@aantonop) February 28, 2018

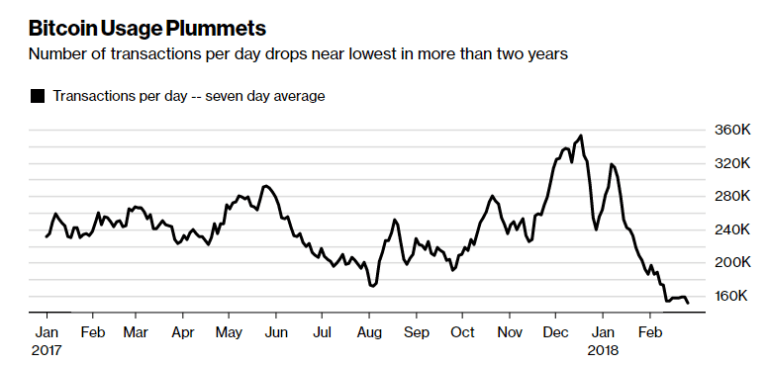

Mainstream publications such as Bloomberg and Forbes have recently reported on the drop in Bitcoins daily transaction volumes. The articles indicated a drop in the popularity of bitcoin and suggested the price has further to fall as usage is dropping. However, many in the crypto community refuted the analysis claiming that it missed some key points; batching, Segregated Witness and spam.

The Bloomberg article cited data from Blockchain.info, a popular bitcoin block explorer. The chart below was used in the article to suggest bitcoin was losing popularity and price will likely follow.

Andreas ‘Don’t botch it on Batching!’

However, what was not mentioned in the article was the recent upgrades from some of the largest exchanges such as Coinbase, Shapeshift and Kraken. These exchanges have recently implemented SegWit and started batching transactions which has reduced the daily bitcoin transaction volume. The author of ‘Mastering Bitcoin’, Andreas Antonopoulous, responded to the article:

“Batching”

Maybe do some research about it?

You're going to need to learn how to evaluate metrics in this new technology. Don't botch it on batching!

— Andreas M. Antonopoulos (@aantonop) March 2, 2018

Batching transactions drastically reduces the number of transactions sent by exchanges to settle user payments. Coinbase was infamous for often sending two transactions to settle one users payment. With optimised transaction batching it is thought this can be reduced significantly.

Wow! A block was mined containing 83% #segwit transactions. 🎉🙌 #bitcoin pic.twitter.com/A2kmBjfF9T

— Armin van Bitcoin ⚡ (@ArminVanBitcoin) March 3, 2018

Many in the bitcoin community also suspect the bitcoin network to have been consistently spammed over the prior 6 months to promote bitcoin cash as the solution to bitcoin’s high fees, which at times surpassed $100 in December.

Segregated Witness has also reduced the lower raw transaction count and is partly responsible for lowering the fees to 6-month lows. Bitcoin block 511677 recently mined a block with 83% SegWit transactions marking an all-time high in SegWit usage.

Community Response

Many users were quick to point out that Bloomberg’s article had missed these key points. In reality the reduction on transactions is likely a combination of SegWit, batching and genuine reduced interest following the peak of the bitcoin rally in December.

hey @EdVanDerWalt why were recently mass adopted protocol improvements such as transaction batching and segregated witness ,which results in much lower raw transaction, skipped over in your article ? https://t.co/e47lt6oYBQ

— I am Nomad (@IamNomad) March 3, 2018

Another useful metric that is perhaps more important than confirmed transaction per day is the estimated USD transaction value. This has also dropped from the peaks in December to the November 2017 levels. In late December the bitcoin price peaked at $20,000 during this brief period the daily transaction value touched $4 billion valuation per day. Unfortunately as bitcoin continues to moves further into the mainstream media’s attention it will continue to be misreported by ‘reputable’ publications.

Thanks to batching the total number of transaction is back to 2016 levels, but this doesn't mean there is less Bitcoin usage. The estimated transaction value in USD by https://t.co/NbvoDQbHgs is still at Nov 2017 levels (just before the crazy speculation period of December) pic.twitter.com/RYA2qLcTEu

— Federico Tenga (@FedericoTenga) March 2, 2018